Meaning of QRMP Scheme.

QRMP Scheme means Quarterly Return Monthly Payment , i.e., we can file return at the end of quarter. But we have to pay tax on monthly basis.

Who All are selected automatically UNDER QRMP Scheme

- Taxpayer having aggregate turnover up to Rs. 5 crore during current or previous year, And

- Taxpayer have filed gstr-1 on quarterly basis.

What I need to do if I have opt for QRMP.

- You need to pay tax every month on or before 25th

- Interest after due date will be levied@18%

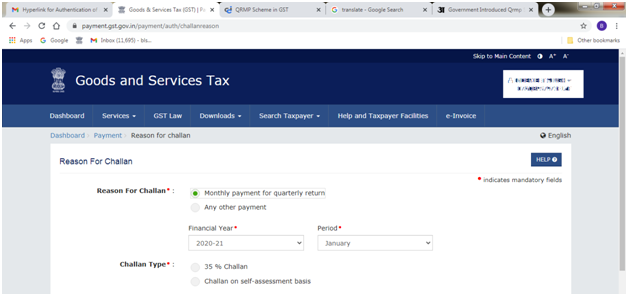

How to pay tax in QRMP.

There are Two method specified in QRMP Scheme to pay tax:-

- Fixed Sum Method:- According to Fixed sum method we have to pay the amount of tax same as paid in last month.

- Self assessment:- According to Self assessment method we have to calculate tax by checking Sale & Purchase and consider actual GST Payable.

Note: We have to pay tax @35% in Q1 of F.Y. 2021-22 only if we file return on quarterly basis under fixed sum method.

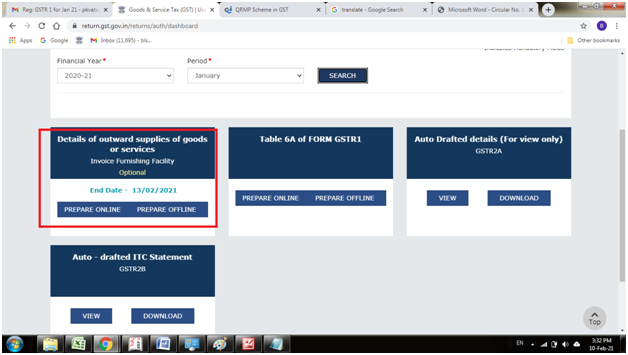

What is IFF.

It is an optional facility provided to QRMP tax payers for uploading the Invoices. QRMP Taxpayer will have the facility (IFF-Invoice Furnishing Facility) to furnish the details of such outward supplies. If we avail the facility of IFF in first and Second month outward supplies will reflect auto-populated in the last month in every quarter.

Example 1

Tax Paid by cash ledger or depositing Challan in Dec 2020 for Rs. 10,000/-

Option 1 : Pay 10,000/- tax selection option of QRMP in create challan

Option 2 : calculate tax liablity by checking output tax and input tax, lets say tax is 12,000/-

Q:- What amount of tax needed to be paid?

A:- Taxpayer may pay any of the above amount.

Example 2

Tax Paid by cash ledger or depositing Challan in Dec 2020 for Rs. 10,000/-

Option 1: Pay 10,000/- tax selection option of QRMP in create challan

Option 2: calculate tax liablity by checking output tax and input tax, lets say tax is 5,000/-

Q:- What amount of tax needed to be paid ?

A:- Taxpayer should pay 5000.

QRMP Scheme just referred Quarterly Return and Monthly Payment. It’s beneficial for all the small taxpayers. And also this scheme is not available for the taxpayer who have turnover more than Rs. 5Cr.

Let us know if there is any query related to this article or any previous article. Contact us.