Today we are going to discuss about the most vital topic of GST and i.e RCM on import of services.

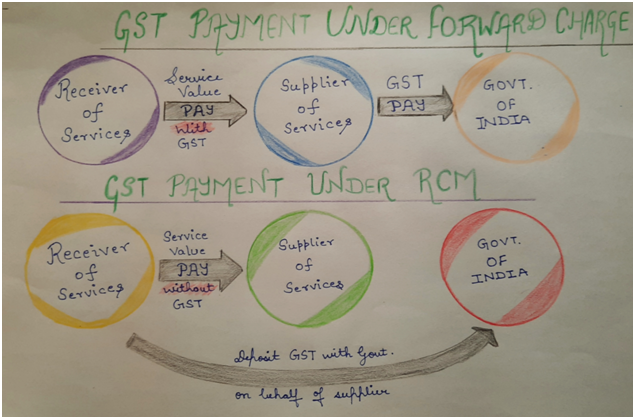

- What is RCM ?

Reverse Charge Mechanism basically means that the GST is to be paid and deposited with the Govt. by the recipient (service receiver) of Goods/ Services and not by the supplier( service provider) of Goods/Services.

2. What is Import of Services ?

Import of services under GST refers to the supply of any services wherein the supplier is located outside India and the recipient is located within India and the place of supply of services is within India. Import of services attracts GST under Reverse Charge Mechanism Basis.

3. Is import of services is taxable under GST?

In order to be taxable under GST, the import of services must be for consideration (payment for services taken), irrespective of whether it is used for business purpose.

For Example — If a person has taken some services from outside India on the name of the company or on the name of a Individual person having GST Registration, then import of services is always taxable. Whereas if a person has taken services from outside India and he doesn’t have a GST Registration, then import services are not taxable in India.

In case the import of services is made by a taxable person from a related party or from any of his or her establishments outside India in the interest of business, it shall be taxable even if such import is made without paying any consideration.

4. Whether ITC can be claimed on Import of Services?

The recipient can avail Input Tax Credit of GST, of amount of tax that is paid under reverse charge on receipt of services by him.

The recipient can use the Input Tax credit of GST in setting of the Output tax liability of GST.

But the amount of RCM on Import on services need to paid in cash only.

For example : Suppose a person has a Output Tax Liability of Rs. 100 and he has imported from goods from outside India on which he has to pay tax on RCM basis Rs 80. Calculate the total amount of GST that he need to pay ?

Ans: Output Tax Liability 100

Less:Input Tax credit on Imported goods 80

Output tax Liability (after setting off ITC) 20

RCM is used to set off the Output Tax Liabilty but the taxpayer need to pay the amount of RCM in cash to the Govt. So Final Tax Liabilty of a taxpayer is Rs 20 + Rs 80 = Rs 100.

5. What is the rate of tax for import of services?

Normal tax on the supply of services as provided in rate list of CGST Act 2017 will be applicable for RCM also. Rate for GST on import of services will be same as in case of domestic supply. Current rate of Tax on services in India under CGST Act 2017 is 18%.

6. Impact of RCM on doing business in India?

The RCM acts as a self-policing tool under the GST framework and aims to curb tax evasion by motivating firms to register themselves under GST and pay taxes.

The main reason of insertion of RCM in GST is to make the system of collection of revenue more convenient. RCM makes it convenient for Govt to collect Tax. And that is the sole reason that RCM have been only notified on the class of services or goods, where Govt finds it difficult to collect the revenue. Govt has notified the type of services on which RCM is applicable, for details about such services, please visit our article “All about RCM” – we can link here – https://www.vatspk.com/save-money-time-with-rcm-a-new-scheme-in-gst/