Contents Covered

- Why we need GST Computation.

- Components of GST Computation.

- Transaction Level Information.

- Relevant Screenshots of GST Portal.

1. Why we need GST Computation for GSTR1 & GSTR3B or any other GST Return Filing?

There are following reasons for the requirement of GST Computation:

- Reduction in errors: It helps to reduce the probability of getting errors while filing GST returns. It ensures a taxpayer to arrive at an accurate amount of tax payable for the period.

- Summary of GST Payable or Carry Forward: The summary of GST payable is essentially the net amount after considering the GST on sales (output tax) and deducting the GST on purchases (input tax credit).

- Avoidance in Underpayment & Overpayment of GST: GST Computation often helps to avoid underpayment or overpayment of GST. Here’s how GST computation contributes to these aspects:

- Accuracy in Tax Liability: By accurately computing the GST payable on taxable supplies and factoring in Input Tax Credit (ITC) for eligible purchases, businesses can determine their precise tax liability. This helps in avoiding underpayment, ensuring that the correct amount of tax is remitted to the government.

- Input Tax Credit (ITC) Utilization: Proper GST computation allows businesses to claim the rightful amount of Input Tax Credit on their purchases. This helps in reducing the overall GST liability, preventing overpayment.

- Data Validation and Reconciliation: Goods and Services Tax (GST) computation plays a significant role in data validation and reconciliation for businesses. Here’s how the GST computation process contributes to these aspects:

- Accuracy in Transaction Data: During GST computation, businesses need to ensure the accuracy of transaction data, including the classification of supplies, determination of values, and application of the correct GST rates. This accuracy is crucial for data validation.

- Matching Output and Input Taxes: GST computation involves calculating both the output tax (GST on sales) and input tax credit (ITC for GST paid on purchases).Matching these two components is essential for data validation and reconciliation to ensure consistency in reported figures.

- Identifying Discrepancies: Regular GST computation allows businesses to compare the calculated GST liability with the information reported in GST returns. Any discrepancies between the computed figures and the reported figures can be identified, leading to further investigation and correction.

- Reconciliation with Financial Statements: Businesses often reconcile GST data with their financial statements. Accurate GST computation helps reconcile the GST liability reported in financial statements with the actual GST payable, providing a cross-check for data accuracy.

- Assistance in Determining Deviation: GST Computation assists us in determining any deviations in GSTR 3B/GST R1 invoices that occur during the month.

- Memorization of adjustments made: For future reference, the GST computation aids in keeping track of the monthly modifications or adjustments made.

- Communication with Stakeholders or Clients: This information is valuable for communicating, discussing, and confirming details with clients. Here’s how GST computation aids in these interactions:

- Summary Information: GST computation generates summary information about the total GST payable and the Input Tax Credit (ITC) available. This summary provides a quick overview of the financial impact of GST on the business.

- Clear Communication of Charges: Transparent communication about the GST computation helps clients understand the breakdown of charges. This transparency is essential for maintaining trust and good client relationships.

- Client Approval: Obtaining confirmation from clients is a form of approval before filing the GST return. It ensures that clients are aware of and agree with the calculated GST liability and ITC before the information is submitted to tax authorities.

2. Components of GST Computation:

- While GST computation can involve detailed calculations and adjustments, it is common and often beneficial to present a summarized version for communication purposes. Summarized information is typically easier for stakeholders, clients, and other non-specialists to understand

- Summary of Output Tax Liability: Provide a clear summary of the total GST liability on sales, showcasing the overall tax amount payable by the business.

- Net GST Liability: Display the net GST liability by subtracting the total Input Tax Credit from the total output tax liability. This is the amount that the business needs to remit to the government.

- GST Computation should also contain detailed information as well:

- B2B Sales: In the context of Goods and Services Tax (GST), B2B sales refer to business-to-business transactions involving the supply of goods or services from one business to another.

- B2C Sales: In the context GST, B2C sales refer to business-to-consumer transactions, where businesses sell goods or services directly to individual consumers.

- Exports: In Goods and Services Tax (GST) terminology, exports refer to the sale of goods or services from a business in one country to a buyer located in another country.

- Other income: “Other Income” in the context of GST computation may include sources of revenue such as interest income, rental income, or any other income streams that are not directly related to the sale of goods or services.

- Credit Note: A credit note is a document issued by a supplier to the recipient (buyer) of goods or services, indicating that the supplier is reducing the amount originally invoiced to the recipient. It is essentially a negative invoice.

- Debit Note: A debit note is a document issued by a supplier to the recipient, indicating that the supplier is increasing the amount originally invoiced. It is essentially a positive invoice.

- Exempt Incomes: “exempt income” refers to income that is not subject to GST. In other words, when a supply of goods or services falls under the category of exempt supplies, no GST is levied on that particular supply, and the supplier is not eligible to claim input tax credits related to the exempt supply.

- Rate wise segregation: GST Computation helps to segregate all the taxable & Non-Taxable supplies under different GST rates mentioned under GST law.

- The same detailed information shall also be made for:

- B2B Purchases: “B2B purchase” stands for “business-to-business purchase.” It refers to a commercial transaction where one business entity buys goods or services from another business entity.

- Imports: In the context of Goods and Services Tax (GST) computation, “imports” refer to the acquisition of goods or services from a foreign country into the domestic market.

- B2C Purchases: Buyers in B2C transactions are individual consumers who directly purchase goods from business organization or services for personal use rather than for resale or further business activities.

- Tax payable Calculation: Tax payable calculation in the context GST computation refers to the process of determining the amount of GST that a business or individual is obligated to remit to the tax authorities based on their taxable supplies and other relevant transactions. The calculation involves several steps and considerations to ensure accurate reporting and compliance with GST regulations. Here is an overview of the key elements involved in tax payable calculation under GST:

- Identify Taxable Supplies: Begin by identifying all taxable supplies made by the business during a specific tax period. Taxable supplies include the sale of goods or services that attract GST.

- Determine GST Rates: For each taxable supply, applicable GST rates are determined by GST Law. Different categories of goods and services may have different GST rates, such as 0%, 5%, 12%, 18%, or 28%.

- Calculate Taxable Value: Determine the taxable value for each supply. This is generally the consideration paid or payable for the goods or services, excluding specified items.

- Compute GST Amount: Multiply the taxable value by the applicable GST rate to calculate the GST amount for each supply. The formula is:

- GST Amount = Taxable Value x (GST Rate/100)

- Aggregate GST Amounts: Sum up the GST amounts calculated for all taxable supplies made during the relevant tax period. This provides the total GST liability before any adjustments.

- Deduct Input Tax Credit (ITC): Reduce the total GST liability by the Input Tax Credit (ITC) available. ITC is the credit that businesses can claim for the GST paid on their purchases and expenses.

- Tax Payable = Total GST Liability – Total ITC

- Consider Other Adjustments: Make adjustments for any other relevant factors, such as reverse charge mechanism, exempt supplies, and non-GST supplies, which may impact the final tax payable amount.

3. Transaction Level Information

- “transaction-level information” refers to detailed information about individual transactions that involve the supply of goods or services.

- All sale, purchase, expense transaction has to be the part of this.

- Transaction-level information includes details about the supply, both from the perspective of the supplier (seller) and the recipient (buyer).

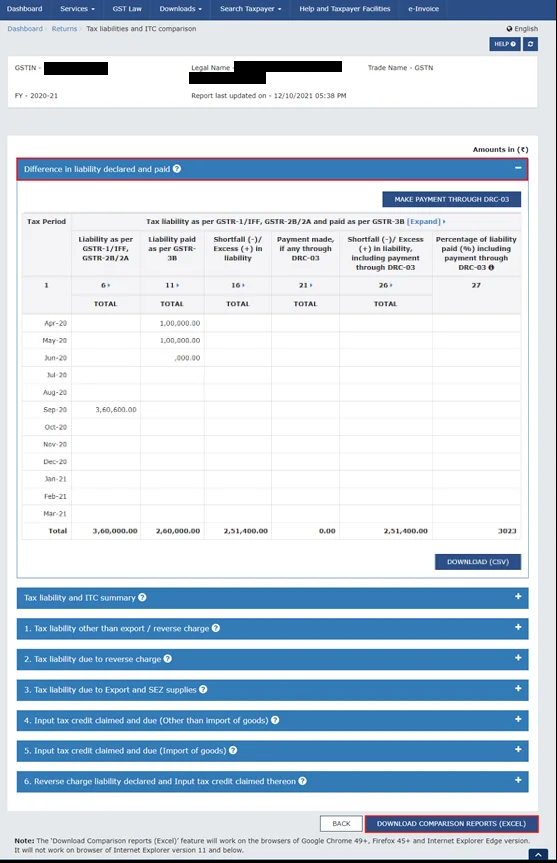

4. Relevant Screenshots of GST Portals

- GST Dashboard screenshot showing Balances of cash & credit ledgers.

- Screenshot of comparative sales declared in GSTR 1 & GSTR 3B/ GSTR2B & GSTR 3B.

Conclusion:

In conclusion, businesses that embrace the principles of accurate record-keeping, compliance, and strategic adaptation to changes in the GST landscape are better positioned to thrive in the contemporary tax environment. As GST continues to evolve, businesses, policymakers, and tax authorities must work collaboratively to ensure that the system remains fair, efficient, and conducive to economic growth. Through effective GST computation, businesses can contribute to a more transparent, accountable, and streamlined taxation ecosystem.

Any Question, feel free to connect with us

740 Views