To become a developed country from a developing country there are strategies that every country adopt. One of the strategy is to promote the export of goods and services. It gives a boost to an economy, create job opportunity and maintain the balance of payment (BOP) of a country.

Government promotes export that’s why they give some benefits and relief under the GST regime to exporters. Under the GST Act, an exporter may export goods or service without the payment of IGST but any registered person availing the option to supply goods or services for export without payment of IGST shall furnish, prior to export, a bond or a LUT in Form GST RFD-11.

What is LUT?

Letter of Undertaking is commonly known as LUT, the LUT is prescribed to be furnished in form GST RFD 11 under rule 96A, whereby the exporter declares that he/she would fulfil all the requirements prescribed under GST while exporting without making IGST payment.

Who can avail the benefits of export without the payment of GST?

Every GST registered person are allowed to avail these benefits under GST regime except the one who have a tax evasion exceed from Rs. 250 Lakh under any Act or prosecuted for any other offence.

Who can file an export bond?

Any exporter who is not eligible to file a LUT have to furnish an export bond.

What is the due date for filling LUT?

LUT will be valid for a financial year and it may filled anytime on or before 31st March every year.

How to file Letter of Undertaking (LUT)?

Here, step by step procedure is given to file a LUT :-

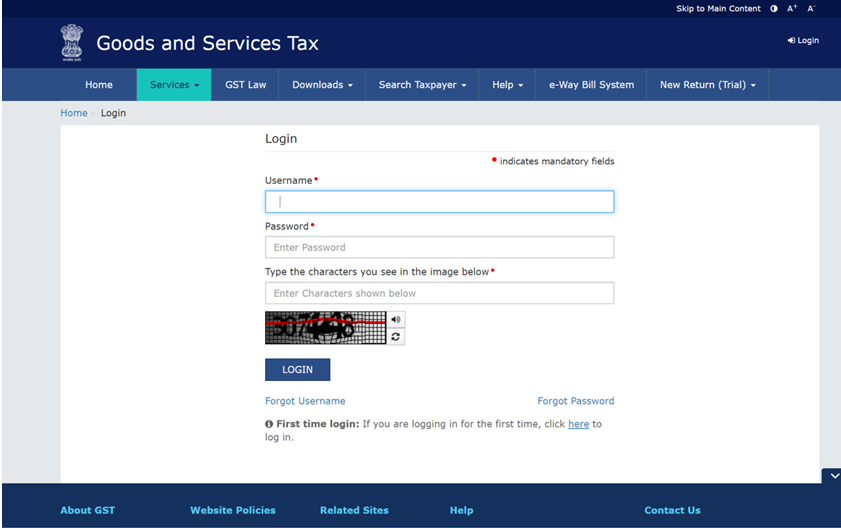

Step 1

Login at GST portal : – https://services.gst.gov.in/services/login

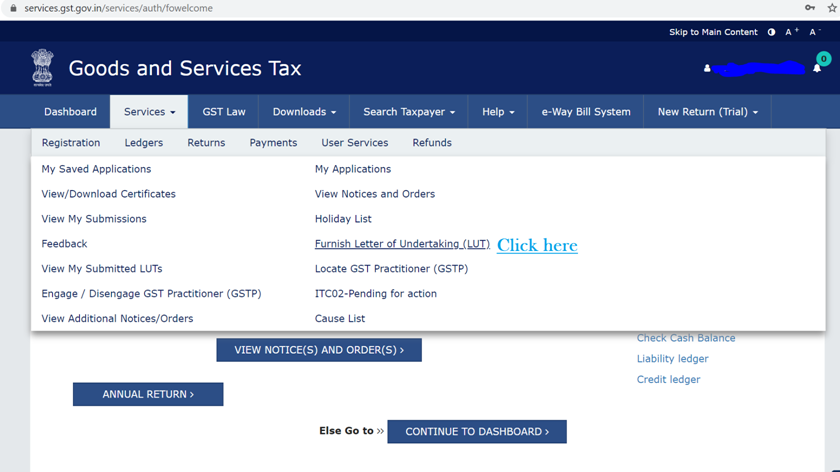

Step 2

Go to Serviecs > User Services > Furnish Letter of Undertaking (as described in image below)

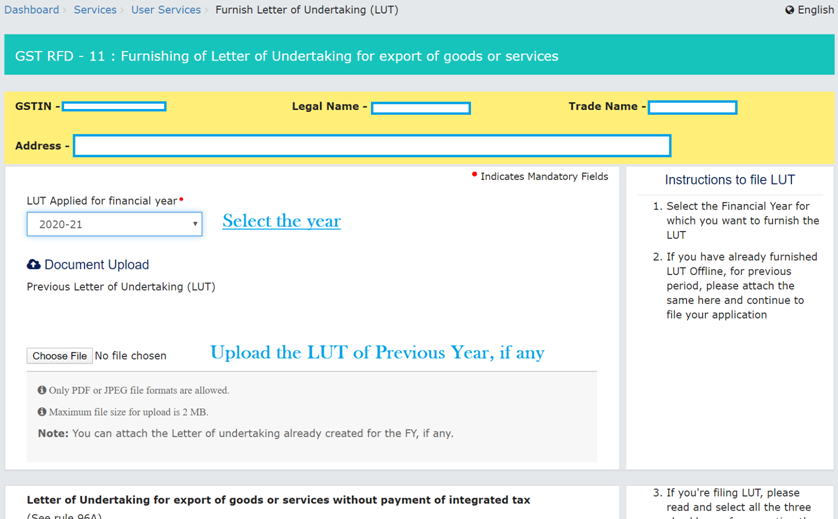

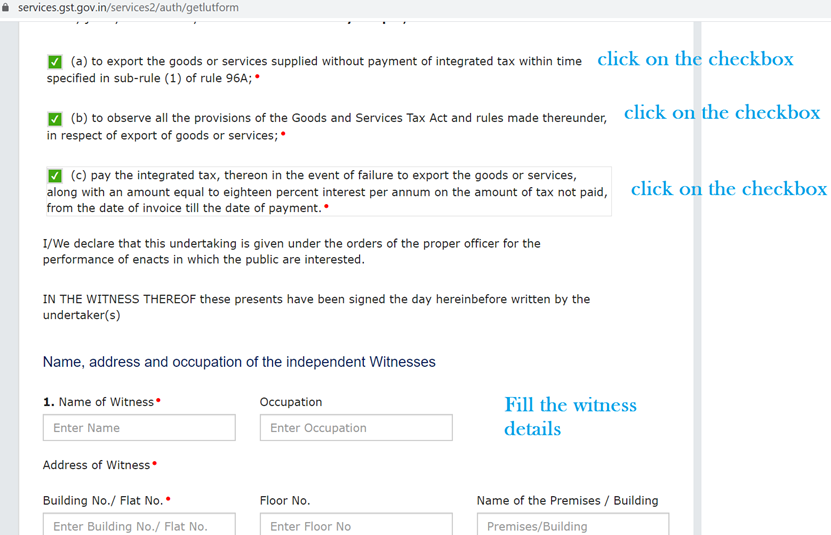

Step 3

Fill the information as described in below images

Step 4

Save the application and file it.

In case, there is any other query related to residential status , connect with us