What is HSN Code?

HSN stands for ‘Harmonized System Nomenclature.’ The WCO (World Customs Organization) developed it as a multipurpose international product nomenclature that first came into effect in 1988 with the vision of facilitating the classification of goods all over the World in a systematic manner.

HSN Code in GST

It is a six digit uniform Code. That classifies more than 5000 products and is accepted worldwide. To be more precise, HSN code added two more digits customs and central excise resulting HSN code 8 digit classification. The purpose of HSN codes in GST is to make GST systematic and GLOBALLY’ accepted, for the following reasons

- Collection of International trade statistics

- Provision of a rational basis for Customs tariffs

- Uniform classification

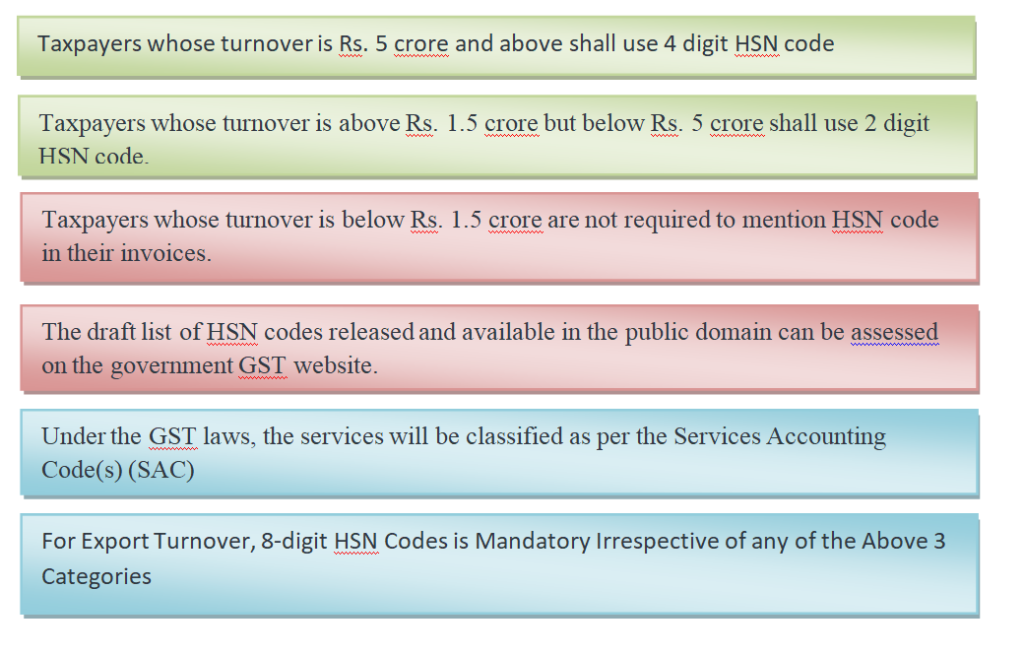

Under GST law, the HSN code to be used by a taxpayer for classification of goods, will be based on the taxpayer’s turnover. The HSN code needs to be declared on the tax invoice and also to be reported while filing the GST returns.

The HSN codes for mandatory mapping/classification of goods that need to be used by a taxpayer are as follows

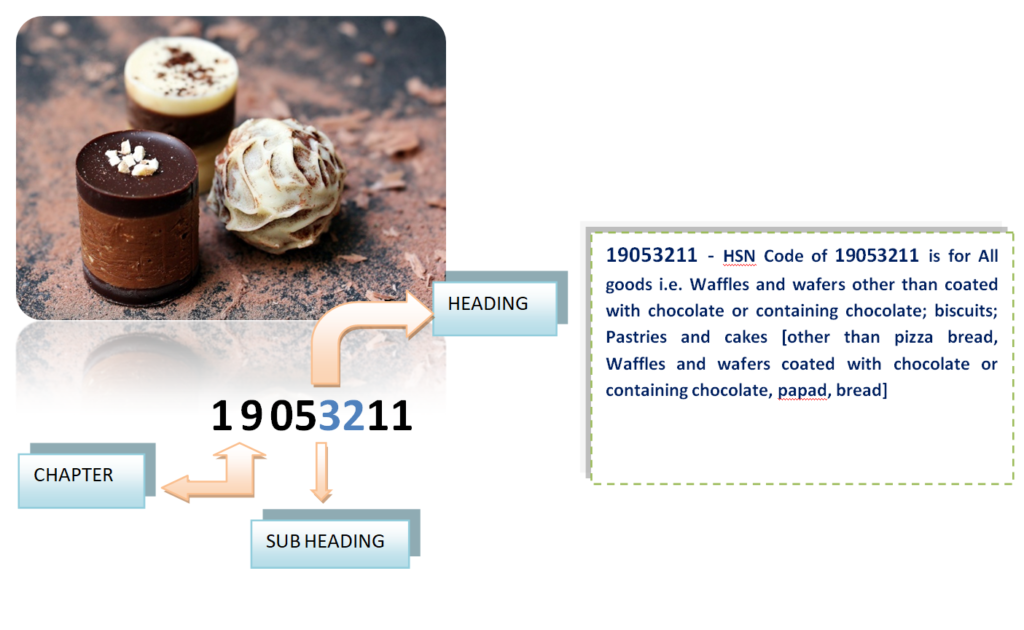

EXAMPLE:

HSN – 19053211

Here 19 is for Chapter, 05 is for heading, 32 is Subheading and last 11 is sub subheading. HSN Code of 19053211 is for All goods i.e. Waffles and wafers other than coated with chocolate or containing chocolate; biscuits; Pastries and cakes [other than pizza bread, Waffles and wafers coated with chocolate or containing chocolate, papad, bread

HSN – Section Wise Summary

The updated HSN and rate of GST may be checked at Govt portal

| Sections | HSN Code List for |

| Section 1 | Live Animals, Animal Products |

| Section 2 | Vegetable Products |

| Section 3 | Animal or Vegetable Fats and Oils and their cleavage products, prepared edible fats, Animal or Vegetable waxes |

| Section 4 | Prepared Foodstuffs, Beverages, Spirits and Vinegar, Tobacco and Manufactured Tobacco Substitutes |

| Section 5 | Mineral Products |

| Section 6 | Product of the chemicals or allied Industries |

| Section 7 | Plastics and articles thereof, Rubber and articles thereof |

| Section 8 | Raw hides and skins, Leather, Furskins and articles thereof, saddlery and harness, travel goods, handbags and similar containers, articles of animal gut ( other than silk-worm gut ) |

| Section 9 | Wood and articles of wood, Wood charcoal, Cork and articles of cork, Manufacturers of straw, of Esparto or of other Plaiting Materials, Basketwork and Wickerwork |

| Section 10 | Pulp of wood or of other Fibrous Cellulosic Material, Recovered ( Waste and scrap ) paper or paperboard, paper and paperboard and articles thereof |

| Section 11 | Textile and textile articles |

| Section 12 | Footwear, Headgear, Umbrellas, Sun Umbrellas, Walking-sticks, seat-sticks, whips, riding-crops and parts thereof, Prepared feathers and articles made therewith, Artificial flowers, Articles of human hair |

| Section 13 | Articles of stone, plaster, cement, asbestos, mica, or similar materials, ceramic products, glass and glassware |

| Section 14 | Natural or cultured pearls, Precious or semi-precious stones, precious metals, Metal clad with precious metal, and articles thereof, Imitation Jewellery, Coins |

| Section 15 | Base Metals and articles of Base Metal |

| Section 16 | Machinery and mechanical appliances, electrical equipment, parts thereof, sound recorders and reproducers, television image and souch recorders and reproducers, and Parts and Accessories of such article |

| Section 17 | Vehicles, Aircraft, Vessels and Associated Transport Equipment |

| Section 18 | Optical, Photographic, Cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus, clocks and watches, musical instruments, parts and accessories thereof |

| Section 19 | Arms and ammunition, parts and accessories thereof |

| Section 20 | Miscellaneous Manufactured Articles |

| Section 21 | Works of art, Collectors’ Pieces and antiques |