TDS Payment is a monthly task that needed to be done by every business, who needs to deduct the tax. We have described the process of TDS payment in the simplest way by explaining all the relevant points as follows:-

Step 1: Open the google chrome or internet explorer and search for “Pay TDS Online”

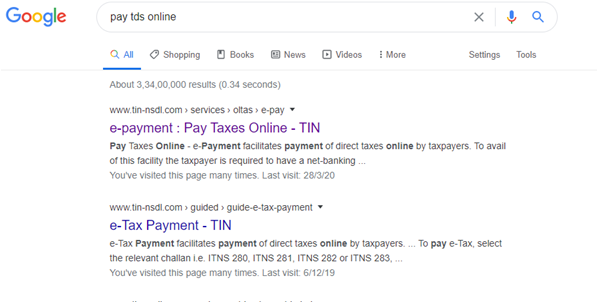

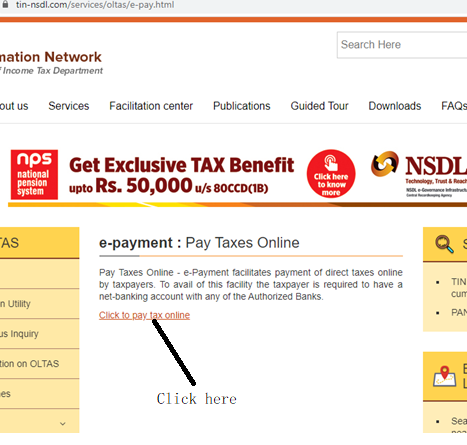

Step 2: Click on the First link “https://www.tin-nsdl.com/services/oltas/e-pay.html” – Always check the payment link, it should always be www.tin-nsdl.com

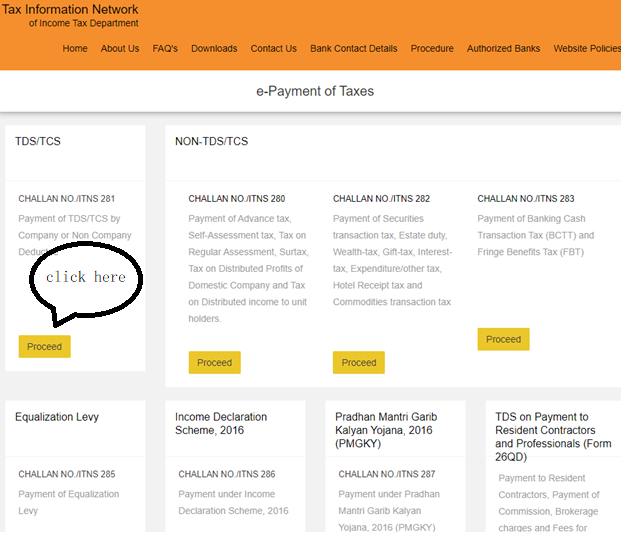

Step 3: Now follow the steps as described in the images below

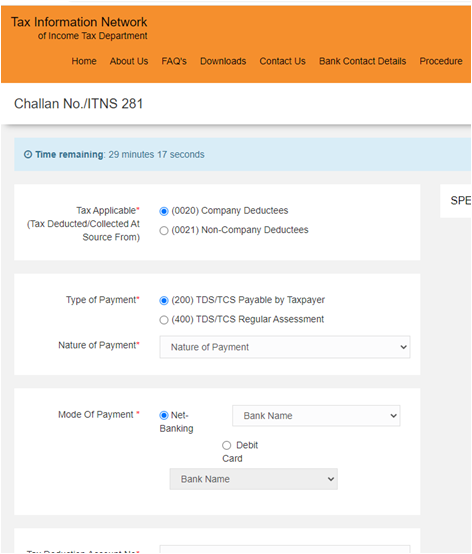

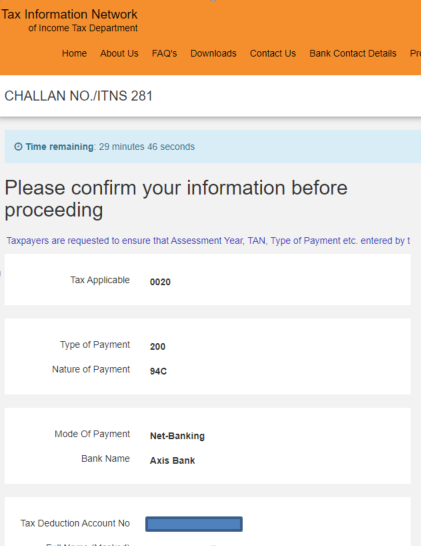

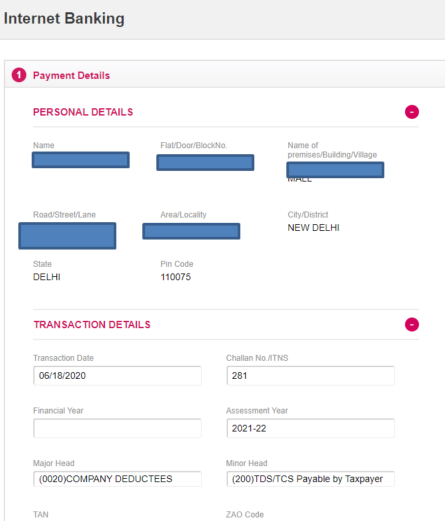

Step 4: The detailed form will get open for filling the information about the tax payment. The points that needed to be taken care are as follows:-

- The very first option asks about the question “whether it is Company deducted or Non-Company deducted”?

- If the person, whose tax is deducted is a company, then it is Company deducted. And in all other cases, it is Non-Company Deductee.

- Type of Payment: Select the option (200) TDS/TCS Payable by Taxpayer

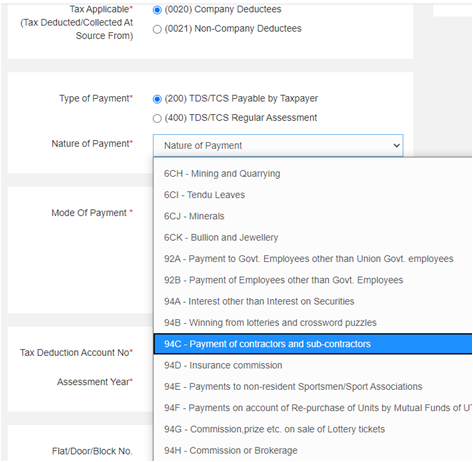

- Nature of Payment: Now we need to select the relevant code for TDS Payment. Examples are if payment of TDS belongs to Rent, then we need to select 94I, and if the payment of TDS belongs to Contractual Service, then we need to select 94C and so on.

- Mode of Payment: Select Net Banking and select the bank, from which payment will be made

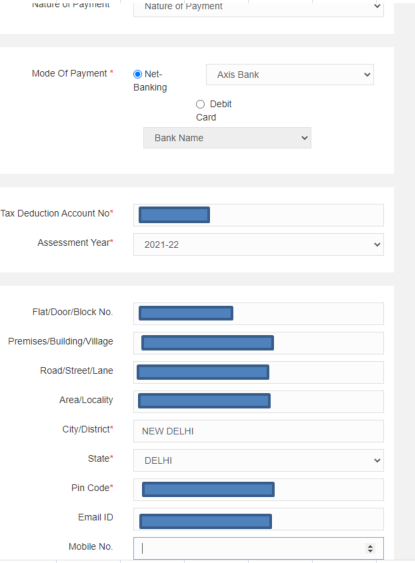

- Tax Deduction Account Number: Fillup the TDS No. here

- Assessment Year: Selec the Assessment Year carefully. It is really important to select the correct Assessment Year. For the current Financial Year, i.e. FY 2020-21, The Assessment Year is 2021-22

- Fill up the address

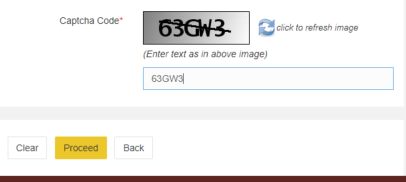

- Fill the captcha and proceed for further step.

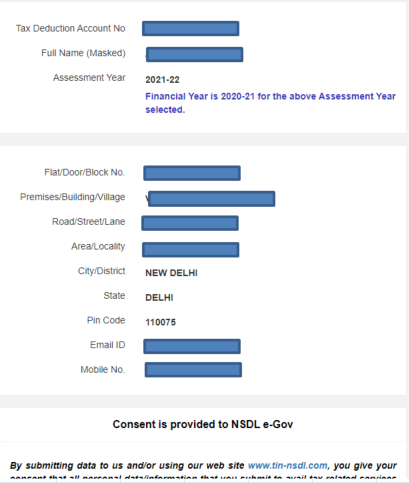

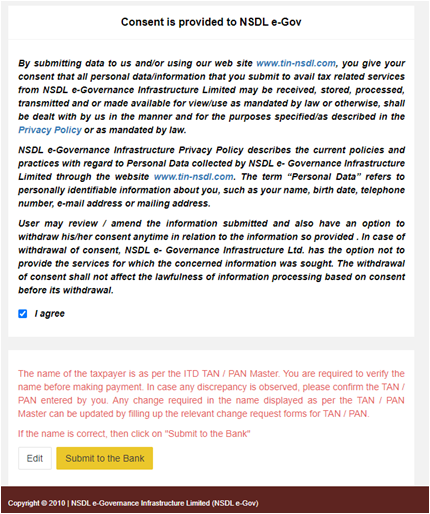

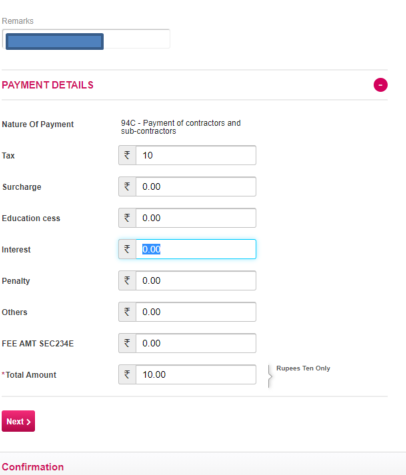

Step 5: Verify all the details filled

- Nature of Payment.

- TAN Number

- Name of the company

- Assessment Year

- And Finally, submit to the Bank

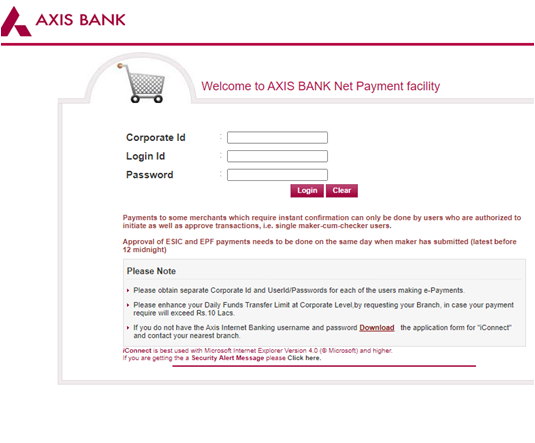

Step 6: Make the Payment of Tax. There are different presentations of different banks for the payment of TDS. So here we have covered the details of the payment of Axis Bank. The payment presentation may differ from bank to bank, but the basic points remain the same. So the below details of Axis Bank payment will be helpful while making payment from other banks as well

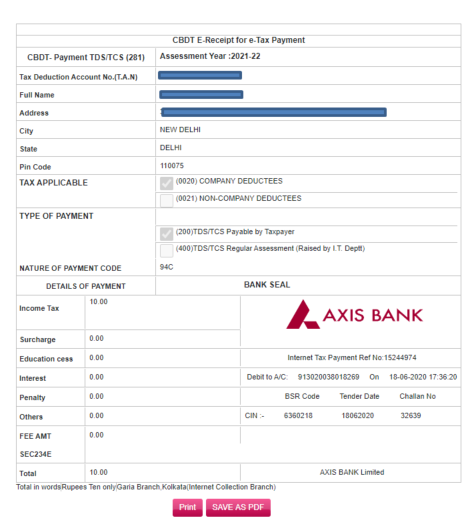

Step 7: Download the challan and save it for future references. The paid challan of TDS looks like as shown in the image below

Key Points

While making payment of TDS, few points must be checked twice.

1. TAN Number and Name of the Company, in order to ensure that TDS is being paid for the correct company.

2. Nature of Payment, i.e. is it contractors(94C), professional(94J), rent(94I) and so on.

3.Assessment Year. For FY 2020-21, AY is 2021-22

4. Amount of Tax and its head of payment.

Is there some query regarding payment of TDS, which is not covered above or is not clear in the above article, feel free to “Connect With Us”