Income Tax needed to be paid at the time of filing of Income Tax Return and it is called as the Self Assessment Tax.

Here is the detailed, Step by Step process of payment of Income Tax

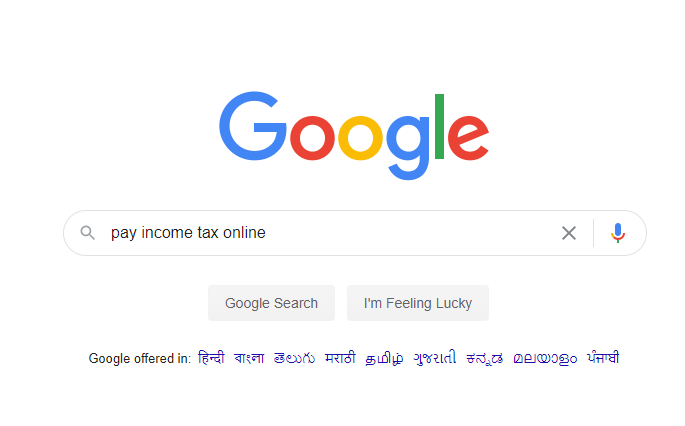

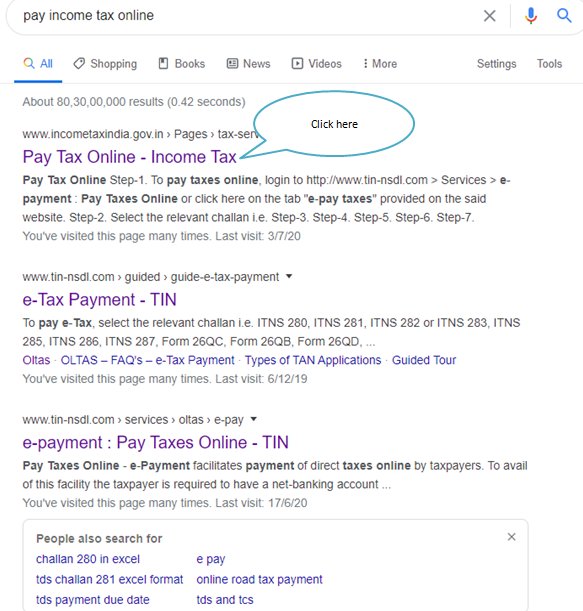

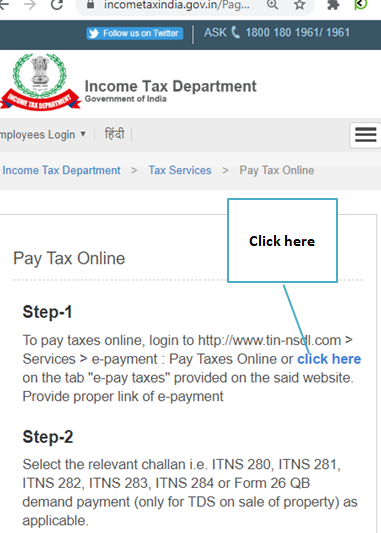

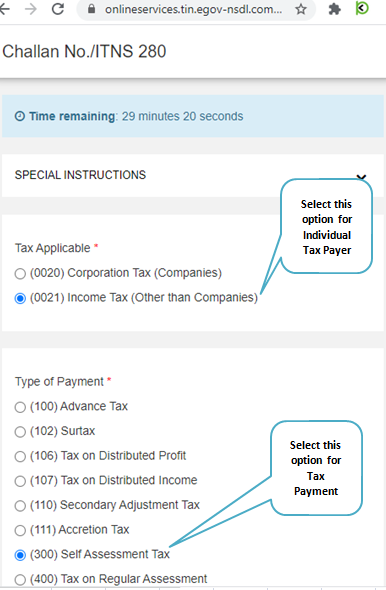

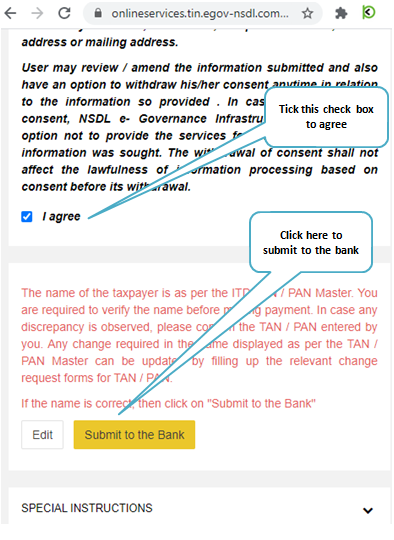

Step 1: Follow the below steps or click on the below link for payment of Income Tax ” https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp ”

.

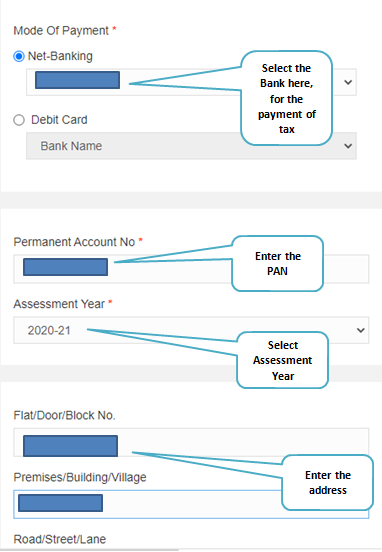

Step 2: Follow the below steps

.

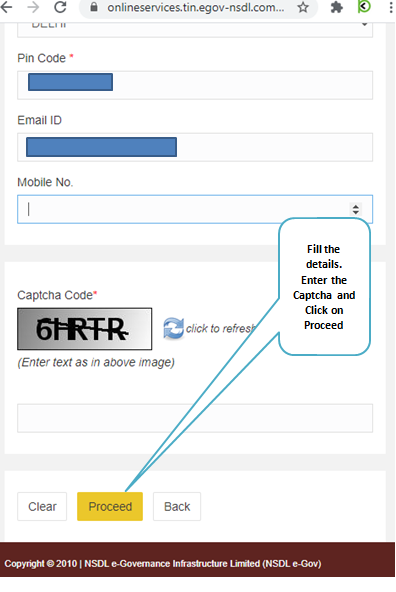

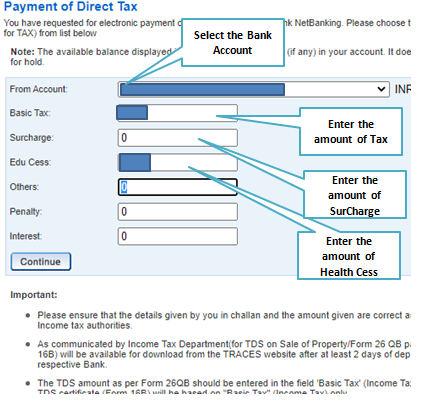

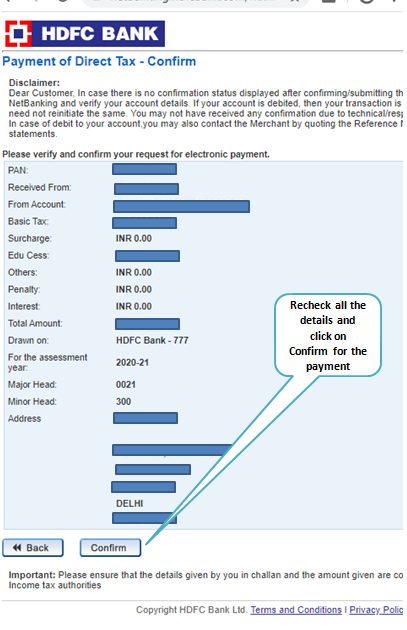

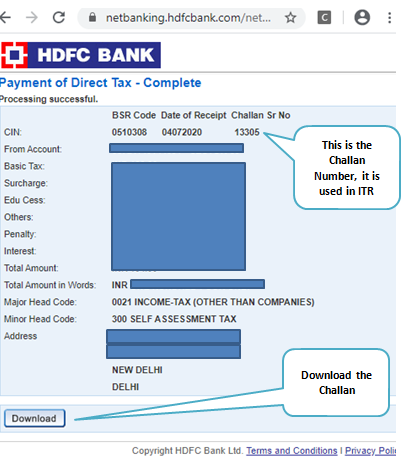

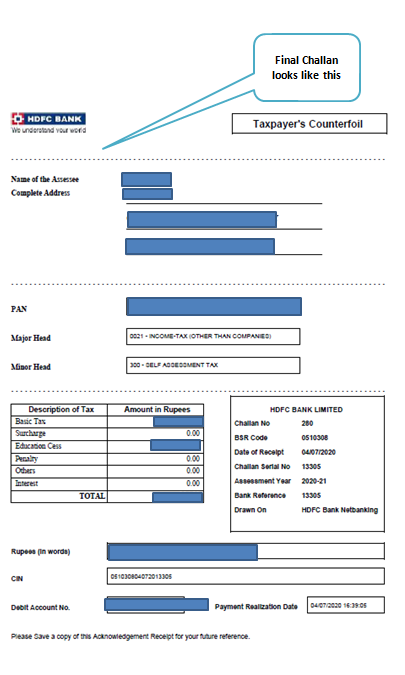

Step 3: Now this is the final step for making the tax Payment. There are different presentations of different banks for the payment of Income Tax. So here we have covered the details of the payment of HDFC Bank. The payment presentation may differ from bank to bank, but the basic points remain the same. So the below details of HDFC Bank payment will be helpful while making payment from other banks as well

Key Points

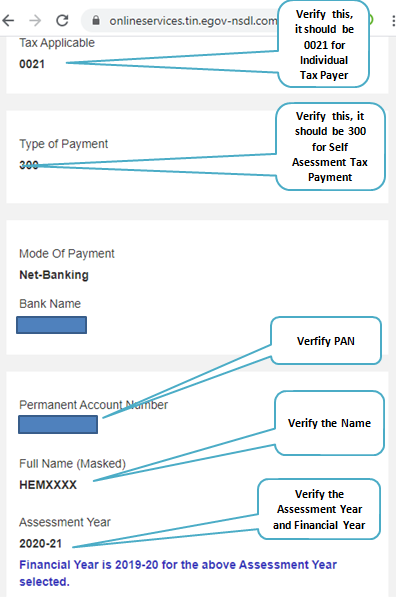

While making payment of Income Tax, few points must be checked twice.

1. PAN and Name as per PAN, in order to ensure that Tax is being paid for the correct Person.

2.Assessment Year needed to be selected carefully. For FY 2019-20, AY is 2020-21

4. Amount of Tax, Surcharge and Health Cess. The total tax payment should be checked carefully.

Is there some query regarding payment of Income Tax, which is not covered above or is not clear in the above article, feel free to “Connect With Us”