Contents Covered

- What is Refund as per Income Tax Act, 1961?

- What is Refund Reissue as per Income Tax Act, 1961?

- What is the process of Refund Reissue as per Income Tax Act, 1961?

- Why Income Tax Refund is not credited in Bank Account?

- Conclusion

1. What is Refund as per Income Tax Act, 1961?

An Income Tax refund refers to the return of excess Income Tax paid by a taxpayer to the government. It occurs when the tax liability calculated on the taxpayer’s income is less than the amount of tax they actually paid through tax withholdings or advance tax.

2. What is Refund Reissue as per Income Tax Act, 1961?

Refund reissue under the Income Tax Act refers to the process by which a taxpayer can request the reissuance of a refund from the Income Tax Department. After filing income tax return if a taxpayer is eligible for any refund and due to any reason if refund is failed then taxpayer can opt for refund reissue from Income Tax Portal.

3. What is the process of Refund Reissue as per Income Tax Act, 1961?

The process of Income Tax refund reissue typically involves the following steps:

- Identification of Need for Reissue: The need for refund reissue arises when the taxpayer is eligible for a refund, but the initial refund transaction failed or was cancelled due to various reasons such as incorrect bank account details, non-nomination of bank account, or other issues.

- Notification: The taxpayer is usually notified by the Income Tax Department regarding the failed refund transaction or the reason for refund cancellation. This notification may be sent through email, SMS, or through the taxpayer’s account on the Income Tax Portal.

- Verification of Details: The taxpayer needs to verify the reason for the refund cancellation and ensure that the necessary corrections are made. This may involve checking and updating bank account details, ensuring PAN-Aadhaar linkage, or resolving any other issues identified by the tax department.

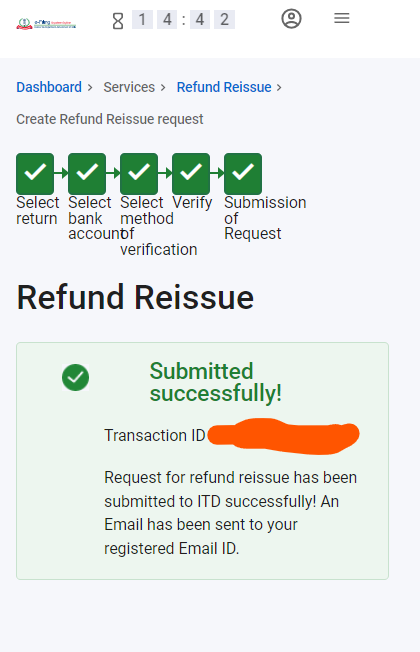

- Submission of Refund Reissue Request: Once the taxpayer has identified and rectified the issue, they need to submit a request for refund reissue to the Income Tax Portal. This request can usually be made through the taxpayer’s account on the Income Tax Portal or by following specific instructions provided by the tax department.Upon receiving the request for refund reissue, the income tax department verifies the information provided by the taxpayer and initiates the process of refund reissue. This may involve cross-checking the updated bank account details, verifying PAN-Aadhaar linkage, or any other necessary verification steps.Once the verification process is complete and the taxpayer’s eligibility for refund reissue is confirmed, the income tax department proceeds with the reissue of the refund. The refund amount is then transferred to the updated bank account provided by the taxpayer within 10 to 20 days.

4. Why Income Tax Refund is not credited in Bank Account?

- Incorrect Bank Account Updated on Income Tax Portal

- Taxpayer Provides Incorrect Bank Account Details: When filing their tax return or updating their profile on the Income Tax portal, the taxpayer provides banking information such as bank account number, IFSC code, or account holder’s name. If any of this information is incorrect or outdated, it may lead to refund failure.

- Bank Account not Nominated for Refund

- Failure to Nominate Bank Account: If the taxpayer fails to nominate a specific bank account to receive the refund, the income tax department may not proceed with the refund transfer.

- Failure to Nominate Bank Account: If the taxpayer fails to nominate a specific bank account to receive the refund, the income tax department may not proceed with the refund transfer.

- PAN-Aadhaar Card no Linked

- Linking PAN with Aadhaar: To avoid refund failure, the taxpayer needs to link their PAN with Aadhaar as per the instructions provided by the Income Tax department. This can usually be done through the Income Tax Portal.

- PAN not Updated in Bank

- Refund Failure: Due non updation of PAN with bank, the refund transaction may be failed by the bank or the Income Tax Department.

- Any Other Reasons

- Failure to Verify Income Tax Return (ITR): If a taxpayer fails to verify their Income Tax Return (ITR) within the stipulated time frame after filing it, the income tax department may cancel the refund. Verification of the ITR is a crucial step in the tax filing process, and it confirms that the taxpayer has reviewed and approved the information provided in the return. Failure to verify the ITR within the specified time period (usually 21 days from the date of filing) can lead to the rejection of the return by the income tax department. As a result, any refund due to the taxpayer may be cancelled or withheld until the verification process is completed.

- Bank Account Issues: Problems with the taxpayer’s nominated bank account, such as closure or inactivity, can lead to refund cancellation.

- Excessive Refund: If the refund amount is calculated incorrectly or deemed excessive, the income tax department may cancel or adjust the refund.

- Fraudulent Activities: Suspected fraudulent activities such as false claims or misrepresentation of income can result in refund cancellation.

- Verification Issues: If there are discrepancies in the taxpayer’s information or if additional verification is required, the refund may be cancelled until the issues are resolved.

5. Conclusion:

Overall, Income Tax refund reissue is a structured process facilitated by the Income Tax Department to rectify failed or cancelled refund transactions. Taxpayers must promptly address any issues and follow departmental instructions to ensure timely resolution. Once verified, the department reissues the refund, transferring the amount to the updated bank account. This process aims to ensure that eligible taxpayers receive their refunds efficiently, enhancing trust and compliance within the tax system.

Any Question, feel free to connect with us