What is E- verification / Verification of ITR?

E-verification / verification of ITR means to verify ITR by electronic or offline mode. E-verification of ITR is a necessary processes after filling the Income Tax Return without which Income Tax Return (ITR) will be considered invalid, if not verified within 120 days of filing of return. So it is a Must Do Task after filing ITR. It verifies the identity of a taxpayer. A taxpayer may be individual or firm or HUF or any other person.

How can a taxpayer verify his ITR?

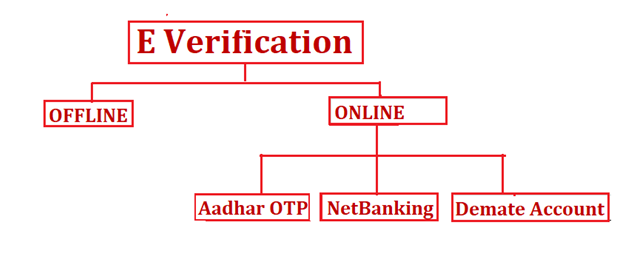

An ITR can be verified either through online or Offline method and both hold equal importance. Like this way there are two methods of verifying ITR as given below –

(a) Offline process (b) Online process

Lets discuss in detail:-

(a) offline process –

In this process the taxpayer follows the following steps–

(i) Download the acknowledgement of Income Tax Return.

(ii) Now take the print out of acknowledgement of ITR and get it signed.

(iii) Send this signed hard copy of Acknowledgement of ITR to CPC, Bangalore through post or speed post to the following address –

CPC, Income Tax Department, Post Box No- 1, Electronic City Post Office, Bangalore- 560500, Karnataka

(b) Online Process of e-verification of ITR –

There are different ways to verify ITR through online mode and these are described below –

First Method – Online verification of ITR through Aadhar OTP :-

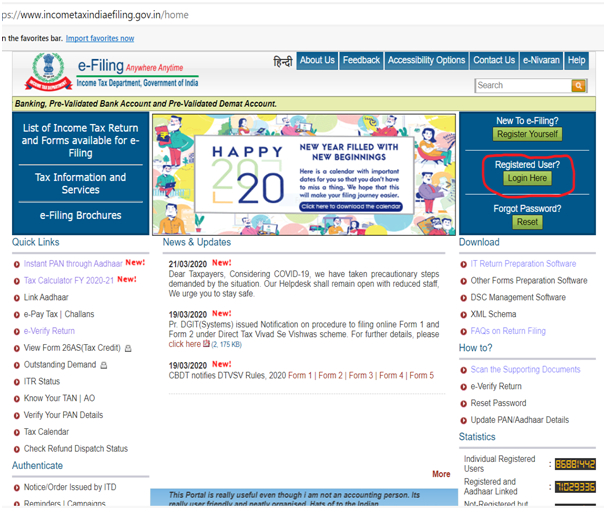

Step 1 : Login to www.incometaxindiaefiling.gov.in Portal

Step 2: Now Click on Login Here Button as shown in the capture below –

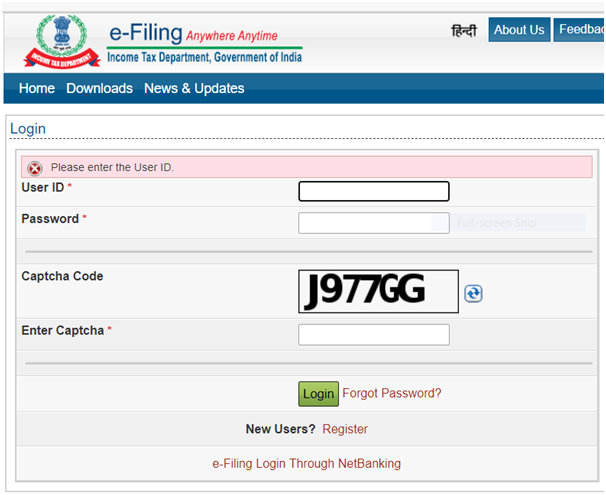

Step 3: Now fill all the details to login as shown below –

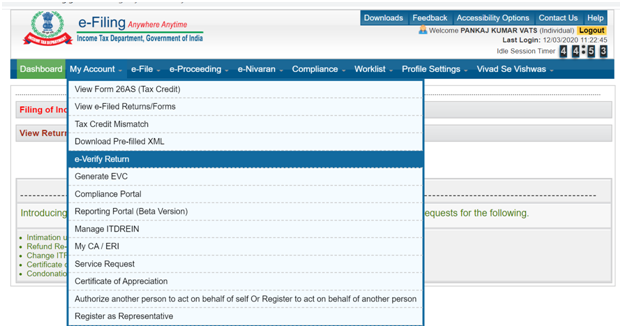

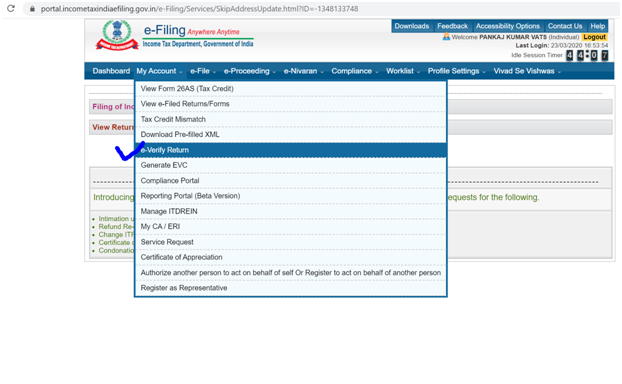

Step 4 : Now click on ‘My Account’ option and select ‘e-Verify Return’as shown below –

Step 5 : Select Verification mode as “Aadhar OTP”

Step 6: Click “Generate Aadhar OTP”. OTP will be sent to mobile number registered with Aadhar and is valid for 30 minutes from the time of generation of OTP.

Step 7: Enter the OTP and click “submit”

Step 8 : ITR Verification Complete.

Second Method- Online verification of ITR through Net Banking:-

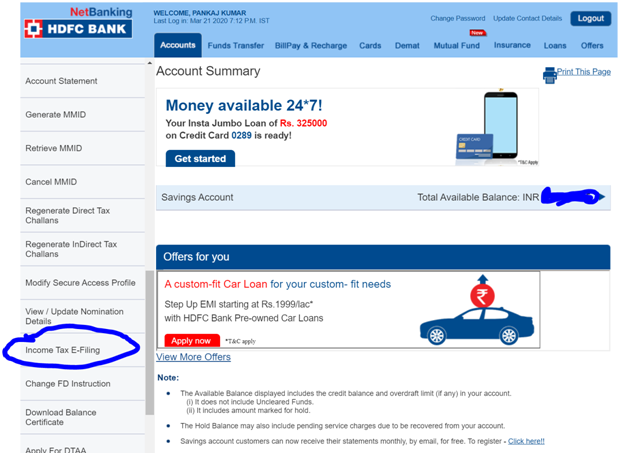

Step 1: Login to Net Banking A/C

Step 2: Search for the Option Income Tax E-Filing and then click on the “Income Tax E-Filing” button

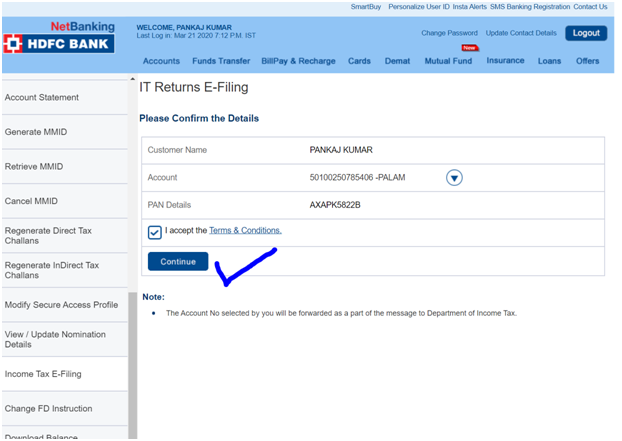

Step 3: Select the Account Number, from drop down and click on continue

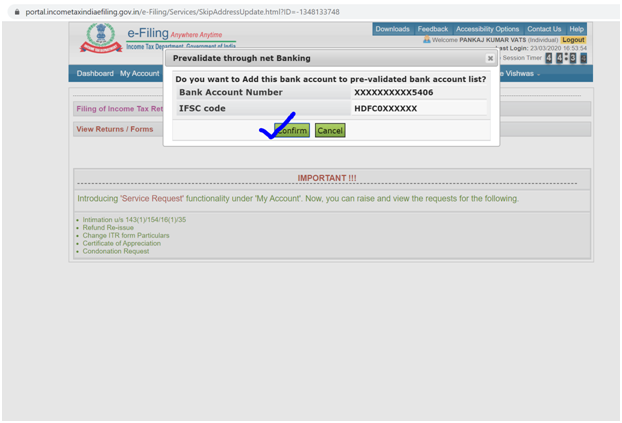

Step 4: Confirm the Details

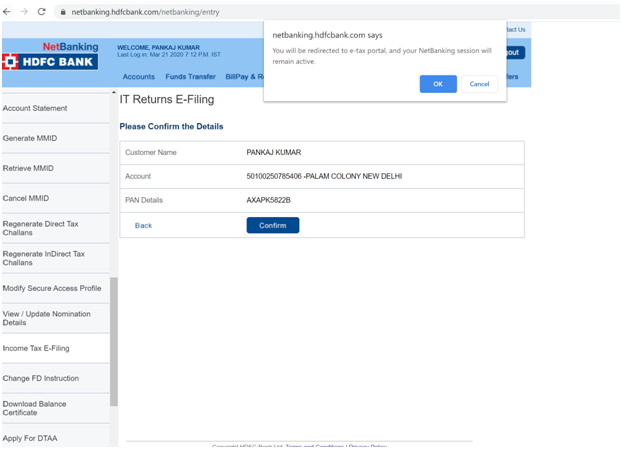

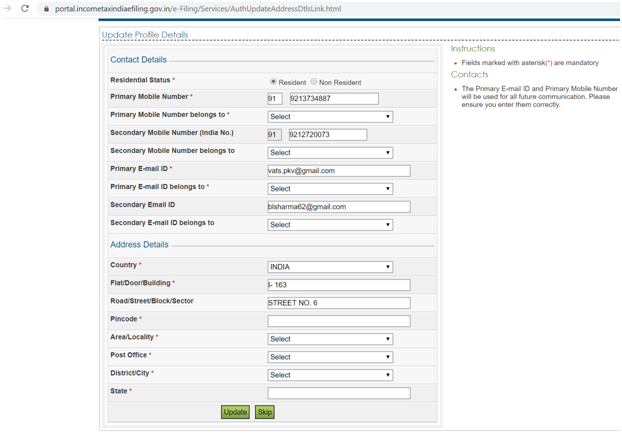

Step 5 : Now click “OK”, on the button new dialogue box which got opened after clicking on the confirm. Now this will take us to the income tax website and our Income Tax Login will automatically will be done

Step 6: Click on the button skip

Step 7: Click on confirm

Step 8: Click on e-verify Return

Step 9: Now just click on the button E-Verify , and the ITR is verified now.

Third Method – Online verification of ITR through Demat Account:-

Step 1: Follow all the steps from first to four used in Aadhar OTP procedure

Step 5: Select Verification mode as “EVC using pre- validated demat account

Step 6: EVC will be sent to the mobile number registered with demat account and is valid for 72 Hours from the time of generation of OTP

Step 7: Enter the EVC

Step 8: ITR Verification Complete

TIME PERIOD OF E-VERIFICATION?

Last date of e-verification is 120 days from the date of filing of ITR.

WHAT ARE THE CONSEQUENCES IF E-VERIFICATION IS NOT DONE?

If a taxpayer does not verify his ITR under any circumstances within 120 days, his Income Tax Return will be marked as Invalid and will be considered as if it was NEVER filed.