Why is it important to reconcile GST?

The procedure for matching GST returns and reconciliation of the data is not new for taxpayers it was already being a part of the VAT and Excise regime. However, it has gained much significance as it is associated with ITC claimed by businesses. So it is very important to match the data in GST returns with the Books of Accounts.

GST reconciliation is a much wider term, so covering all the points of GST Reconciliation in one article is not a good idea. Therefore here in this article, we will talk about a few important GST reconciliation areas:

- GSTR1 vs GSTR3B

- GSTR1 vs GSTR3B vs Books of Accounts (Outward supplies)

- GSTR3B vs GSTR2A

- GSTR3B vs GSTR2A vs Books of Accounts (inward supplies)

Let us discuss all one by one

- GSTR1 vs GSTR3B

If there is any mismatch arises in the compliance Furnished (GSTR1 with GSTR3B) on the GST portal, it is the scope of doing necessary adjustments to correct it. For example, if we paid less tax in GSTR3B then we have to identify the reason and need to pay the remaining tax with interest as soon as possible. Comparing of GSTR-3B and GSTR-1 is a much-needed process that has to done by all the taxpayers to ensure that no gaps have left between them otherwise there may be a scope of unwanted issues/notices from tax authorities.

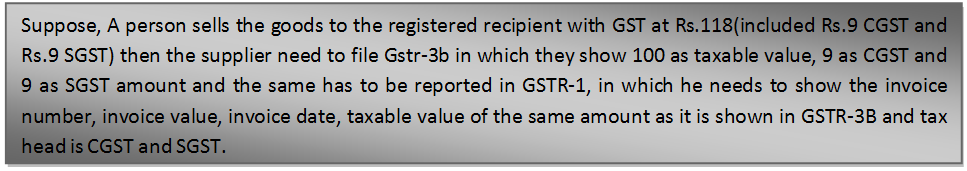

GSTR-3B is a monthly summary return filed by the taxpayer and discloses supplies made along with GST to be paid, ITC claimed, RCM purchases, etc. and if payment of GST on outward supplies due after claiming ITC then it should be paid before filing the return.

GSTR-1 is a monthly/quarterly return filed by the taxpayer to disclose all details related to their outward supplies along with tax liability. The Taxpayer has to upload the invoice-wise details of their outward supplies so that Govt. can check every transaction and the counterparty can verify their purchases. It is very important because GSTR1 details of one party enable the purchaser to validate its purchases and input claims.

The matching of both returns i.e. GSTR 3B and GSTR 1 is important because it has a direct impact on the Annual Return GSTR-9 and effects the GSTR-9C GST Audit as well. The deviation in GSTT 3B and GSTR 1 may also lead to tax liabilities.

2. GSTR-3B vs GSTR-1 vs Books of Accounts (outward supplies)

GSTR 3B vs GSTR 1 Reconciliation is the first step towards the reconciliation of Output Tax Liability and Total Sales. Now comes the final reconciliation, i.e. reconciliation with books of accounts. The data reported in GSTR 3B and GSTR 1 should be in consonance with books of accounts.

3.GSTR-3B vs GSTR-2A

GSTR 3B vs GSTR 2A reconciliation is One of the Most Important Reconciliation.

The Key objectives of GSTR 2A are explained below:-

- This reconciliation helps in the identification of Inputs and Expenditure which were left to be considered in books of accounts if any.

- It helps in Identifying the Vendors, they who have not shown our purchase invoices in their GSTR 1

- It brings confidence on the amount of Input claimed

Let us Understand this Reconciliation in detail

GSTR 3B contains the information which is a self-declared summary of inward supplies.

It contains the information head wise (IGST, SGST, and CGST), likewise adjustment regarding blocked ITC, the reversal of ITC, etc.

GSTR 2A is an auto-populated return. When the suppliers file their GSTR-1 disclosing its sales, the corresponding figures are reflected in GSTR 2A of the recipient. The Amount in GSTR-3B in table 4(a) must be matched with tax details auto fetched in GSTR 2A.

4. GSTR3B vs GSTR2A vs Books of Accounts (Inward Supplies)

Now comes the Final reconciliation of input claimed in GST. Inputs may be in the form of purchases made, services received, on account of RCM, on account of purchases, and so on. Here we are talking about the Input reconciliation of goods purchased and/or services received.

As per the GST Law, it is mandatory for claiming the input that the supplier must pay the tax and files it is GSTR 1 and shows the complete details of supplies made to the recipient.

So this is really a time-consuming reconciliation because it has to be done for every single invoice of purchase of goods or receipt of service. It has to be done in such a way that all the invoices in books of accounts gets verified with GSTR 2A

Conclusion

GST Reconciliation is really a big task. Therefore it has to be done in phases. Two major GST reconciliations are the reconciliation of the total output and total input.

Output Reconciliation: One should ensure that tax has been paid for all the sale invoices booked in books of accounts.

Input Reconciliation: One should ensure that all the Inputs claimed in books of accounts, have been verified with GSTR 2A and if any input is left, that has also been considered with the help of GSTR 2A.