GST is an indirect tax levied on all goods and services in India. To foster education to every child, essential educational services have been kept out of the ambit of GST. However, certain educational courses and training program attracts GST. Hence, the applicability of GST would depend on the type of course and its provider.

“Education” is not defined in the CGST Act but as per Apex Court decision in “Loka Shikshana Trust v/s CIT”, education is the process of training and developing knowledge, skill, and character of students by normal schooling.

Under GST, “educational services” is defined as providing services by way of:

- Pre-school education and education up to higher secondary school or equivalent;

- Education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force;

- Education as a part of an approved vocational education course

Classification of Education Services under GST:-

Educations Services are classified into six groups vide Notification no. 11/2017- central Tax (rate), Dated 28.06.2017 . The details of classification of education services as under:

(1) Pre- primary education services

(2) Primary education Services;

(3) Secondary education Services.

(4) Higher education Services.

(5) Specialized education Services.

(6) Other education & training services and educational support services

What is an Educational Institution ?

Education Institution means an Institution engaged in providing:-

- Pre School Education Upto Higher Secondary

- Education as a part of the curriculum for Obtaining Qualification Recognized By any Law

- Education as a part of an approved vocational education course

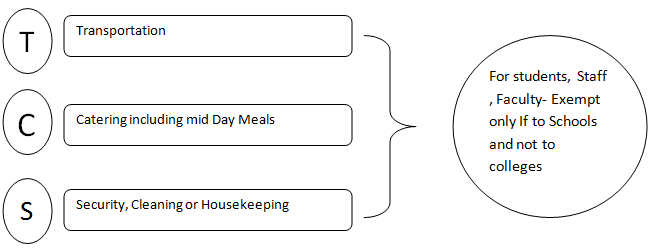

To keep the cost of education minimum it is also necessary that the cost of Education services does not get increased by the GST component for the services procured by Education Institutions. Considering this factor, our Government has exempted the class of services exempted from GST. This simply means if any person providing these services to the Educational Institutions, it will be exempted from GST.

GST rate on Educational Services, if the same is not covered by the above exemptions is 18%. In simple words, if Education Institution provides some auxiliary services in addition to education, the is chargeable with the GST @ 18%.

Conclusion

Education service is exempt from tax if the same is provided by the Educational Institutions. Auxiliary services received by education institutions for educational purposes are also exempt from tax, in order to keep the cost of education minimum. However, services, other than education provided by education institution are under the ambit of GST and are taxable @ 18%

Any doubt or clarity needed, ask your question at “Connect”