The due date of GST Returns, has not been extended, however keeping in view the difficulties faced by the GST tax payer, Ministry of Finance, Department of Revenue, Central Indirect Taxes and Customs Department has waived off late fee on GST return filing. The details of waiver of late fee are notified in Notifications 30/2020 to 36/2020 dated 03.04.2020. Circular No. 136/06/2020-GST dated 3rd April, 2020 has been issued.

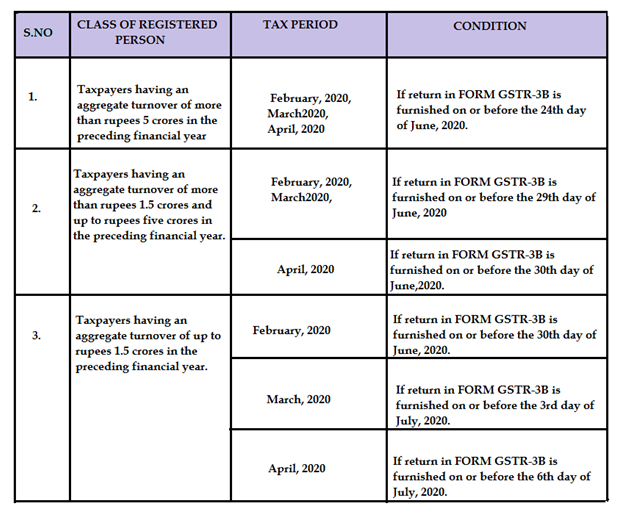

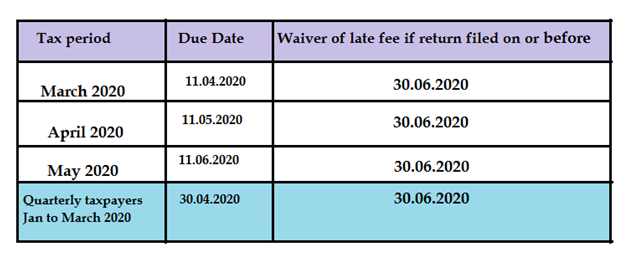

1. Normal Taxpayers filing Form GSTR-3B, Waiver of Late Fee details fee Details

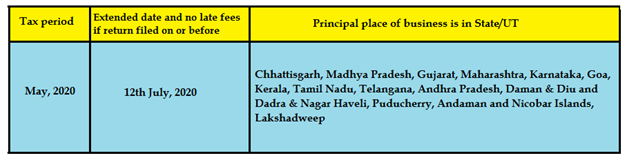

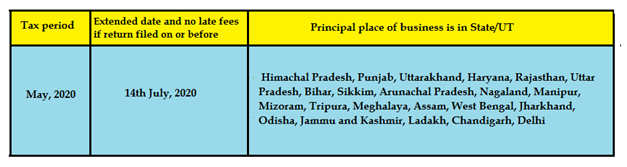

2. State Divided in two GROUP- I & II For Taxpayers having aggregate turnover of upto Rs. 5 Cr. in preceding FY.

GROUP – I States/UTs

GROUP – II States/UTs

3. Validity of E-way Bill

Where e-way bill expires between 20.03.2020 and 15.04.2020, validity deemed to have been extended till 30.04.2020

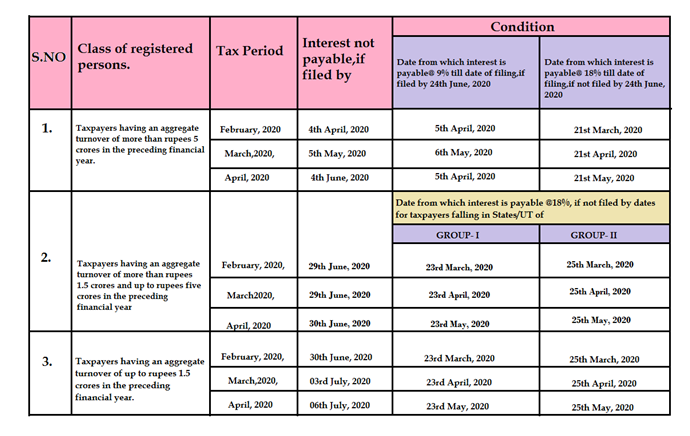

4. Interest liability for filing Form GSTR-3B

5. Normal Taxpayers filing Form GSTR-1

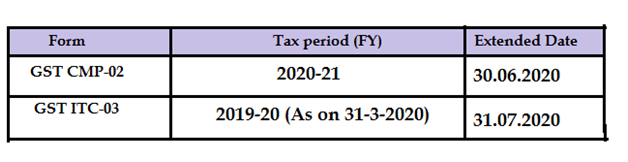

6. Opt in for Composition in FY 2020-21

Normal Taxpayers wanting to opt for Composition should not file GSTR3B and GSTR 1 for any tax period of FY 2020-21 from any of the GSTIN on the associated PAN.

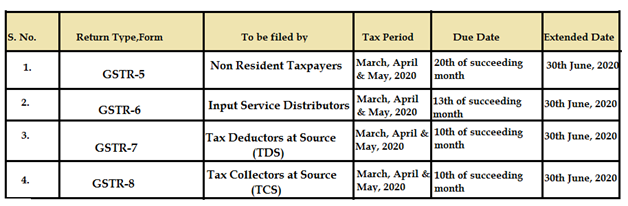

8. NRTP, ISD, TDS & TCS taxpayers:

If you have any query related to this article or any other article than please contact us