What is An E-way bill?

E-way bill is a document required by a person in charge of the conveyance carrying any consignment of goods of value exceeding Rs. 50,000 / Delhi (1,00,000) as mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed there under. It is generated from the E-Way bill portal for E-Way bill system by the registered persons or transporters who cause movement of goods.

E-way bill is a document which authenticates the transportation of goods. It is a tool to curb the ill practices by making the transportation records online, which makes it easy and convenient for the Govt to identify the authenticity of the goods which are being transported.

Why is the E- way bill required?

Section 68 of the Goods and Service Act mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified, to carry with him such documents and such devices as may be prescribed. Rule 138 of CGST Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods in certain prescribed cases. Hence e-way bill generated from the common e-way bill portal is required.

Who all can generate the E-Way bill?

The consignor or consignee, as a registered person or a transporter of the goods can generate the e-way bill. The unregistered transporter can enroll on the common portal and generate the e-way bill for movement of goods for his/her clients.

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( For instance, return)

- Due to inward ‘supply’ from an unregistered person

The nature of supply should be:

- Made for a consideration (payment) in the course of business

- Made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment) in simpler terms, the term ‘supply’ usually means:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

STEP BY STEP GUIDE FOR GENERATING NEW E WAY BILL:

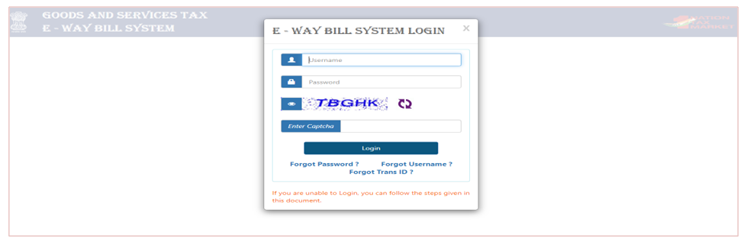

STEP:1 LOGIN AT https://ewaybill.nic.in/ AND PROCEED TO LOGIN.

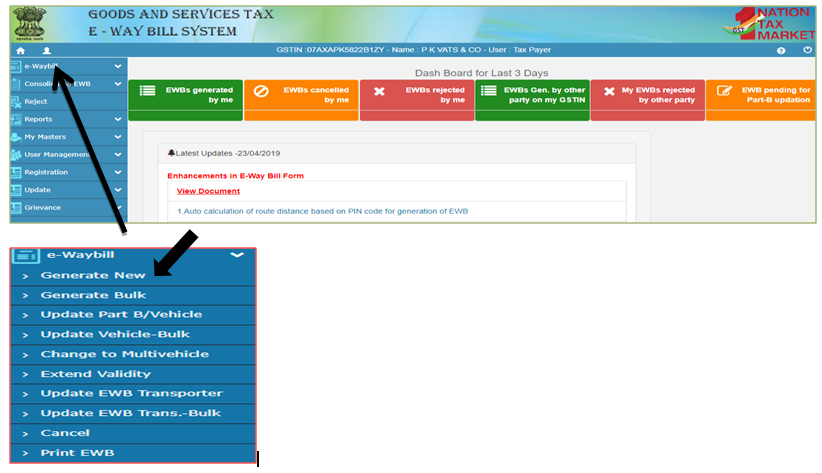

STEP:2 Now go to e-way bill section and press below Generate New.

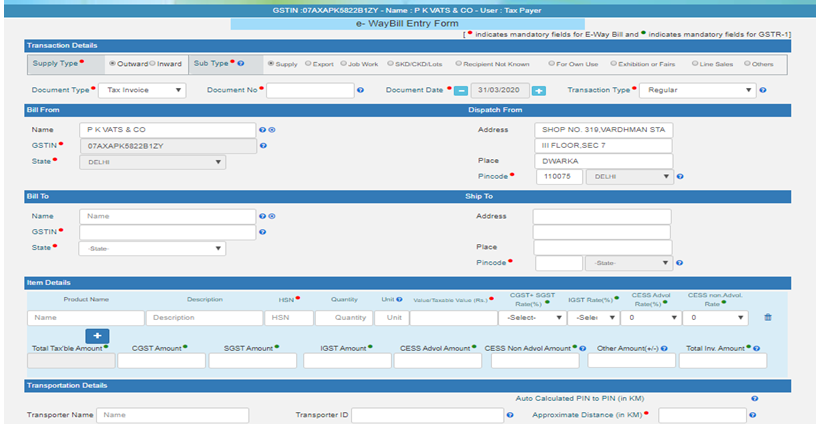

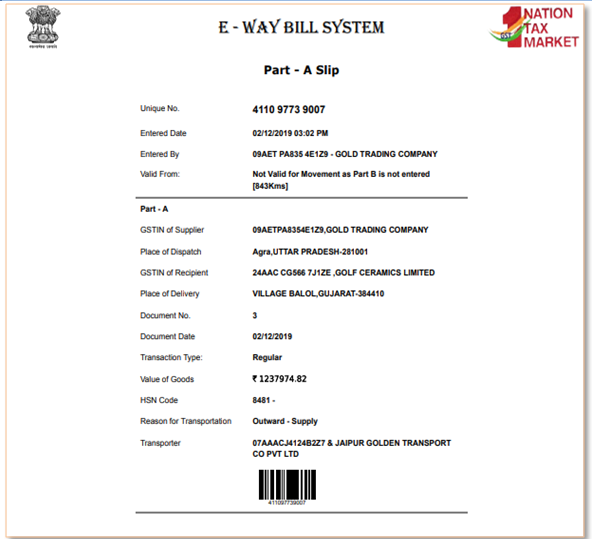

STEP 3: WE HAVE E-WAY BILL ENTRY FORM, WHERE PART A AND PART B IS THERE, AND THE SAME NEEDED TO BE FILLED TO GENERATE EWAY BILL.

PART A:- CONSISTS OF TRANSACTION DETAILS, BILL FROM, DISPATCH FROM, BILL TO, SHIP TO, ITEM DETAILS

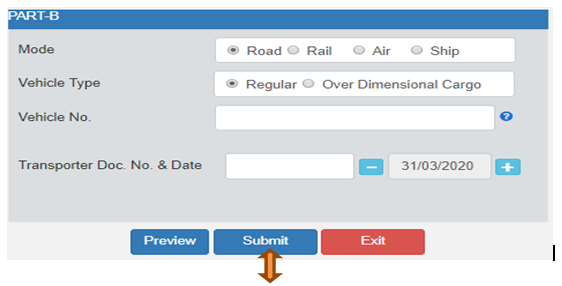

PART B:- CONSISTS, TRANSPORTATION DETAILS

WE HAVE TO FILL ALL NECESSARY INFORMATION AS INDICATED MANDATORY WITH RED MARK

PART A

FILL PART B:- ALSO AND THEN SUBMIT PRESS SUBMIT BUTTON AFTER CHECKING PREVIEW.

STEP4: CHECK THE EWAY BILLS DETAILS AND SUBMIT.

Just in case, there needed more clarification or information relating to eway bill, connect with us.