Do you want to SAVE MONEY ?

If the question to above answer is yes, then surely this article will help.

Paying tax is really good. Everyone should pay the taxes, however one should also think about the Govt policies with respect to payment of Taxes. Our Govt has specified some investments and schemes, which can help us in saving taxes. So it is really important that we should be aware of these benefits given by the Govt. Such tax saving benefits are described in Chapter VIA of Income Tax Act, 1961

There is an Old Saying “Money Saved is Money Earned”

Do you claim some deductions under chapter VI-A to reduce your tax liability?

So, here we are going to discuss about this questions in this article. If your Total Income is more than Rs. 2,50,000/- annually, then you are liable to file your Income Tax Return (ITR). The tax liability may be reduced by claiming some deductions under chapter VI-A of Income Tax Act, 1961. Only Individual and HUF, are eligible to claim this deduction under Chapter VIA and that too, only when he/she made tax saving investments or incurred eligible expenses in that particular Financial Year.

So, let’s began with the various section with their threshold limit and conditions which need to be completed to claim deductions under chapter VIA. It is really very useful to reduce your tax liability

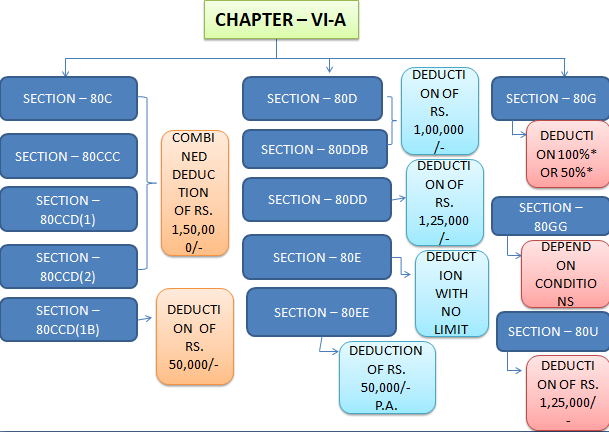

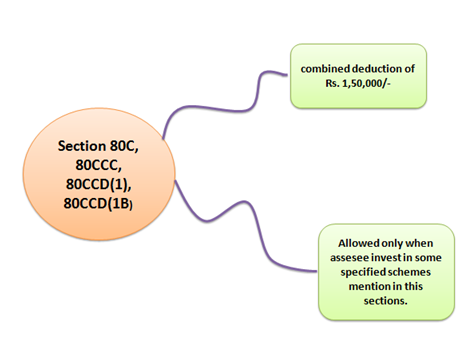

There are various section which are very useful to claim deduction so here we are discussing about very common section i.e., section 80C, 80CCC, 80CCD(1), 80CCD(1B) under which an assessee may claim a combined deduction of Rs. 1,50,000/- but this deduction will claim only when assesee invest in some specified schemes mention in this sections.

There is one more new section added by Indian Govt. in this chapter VIA i.e. Section 80CCD(2), where an assesee can claim extra Rs. 50,000/- deduction for the deposit under National Pension Scheme of Central Govt.

Some Examples of Section 80C Deduction

- Life Insurance premium

- Repayment of Housing Loan

- Unit Linked Insurance Plan

- School Fee

- Public Provident Fund (PPF)

- National Savings Certificate (NSC)

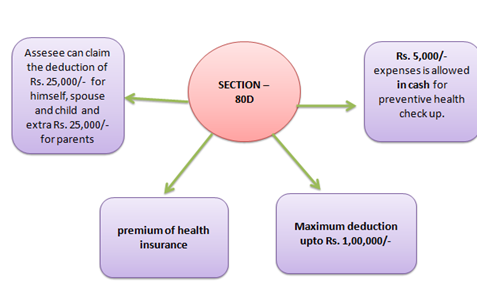

Apart from these investment sections there are some deduction which available on expenses done by an assesee in that particular F.Y. like, premium of health insurance (Section – 80D) here assesee can claim the deduction of Rs. 25,000/- for himself, spouse and child Rs. 25,000/- for parents. But if the age of assesee or his/her parents is more than 60 years than this amount will increases to Rs. 50,000/-. Therefore, an assesee may claim the maximum deduction upto Rs. 1,00,000/- at here where, Rs. 5,000/- expenses is allowed in cash for preventive health check up

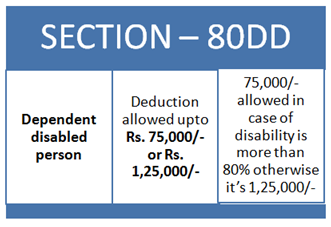

There’s an important fact that we not only claim the expense of premium on health insurance but we can also claim the expenses done for the treatment of dependent disabled person upto Rs. 75,000/- or Rs. 1,25,000/- under Section – 80DD

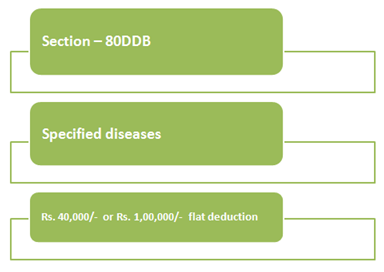

and there is a one more deduction of Rs. 40,000/- or Rs. 1,00,000/- flat deduction (only for senior citizen or super senior citizen) in case of Specified diseases under the Section – 80DDB

Dependent means in case of individual – Spouse, Children, Parents, Brother or sister who is wholly dependent on assesee

Dependent means in case of HUF – A member of HUF who’s is wholly dependent on such HUF.

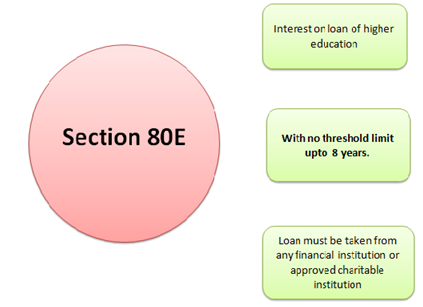

An assesee may also claim some deduction for the interest on loan of higher education with no threshold limit upto 8 years. But this deduction is allowed only when loan is taken from any financial institution or approved charitable institution only under the Section 80E.

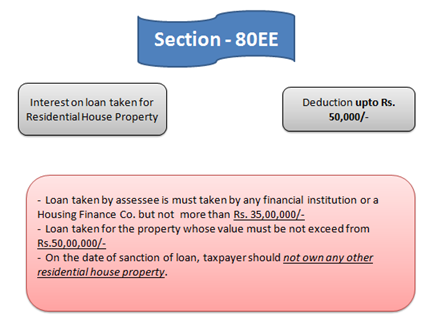

There is a Section – 80EE named Interest on loan taken for Residential House Property where an assesee claim the deduction upto Rs. 50,000/- but there are certain conditions to claim deduction i.e.,

- Loan taken by assessee is must taken by any financial institution or a Housing Finance Co. but not more than Rs. 35,00,000/-

- Loan taken for the property whose value must be not exceed from Rs.50,00,000/-

- On the date of sanction of loan, taxpayer should not own any other residential house property.

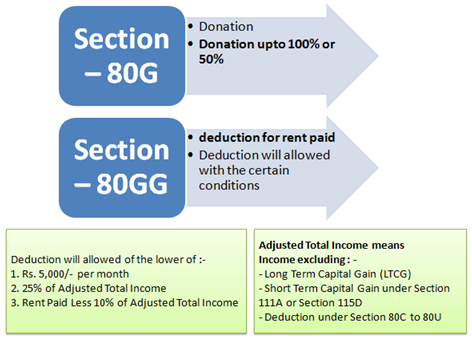

As we discuss about deductions which are very helpful to reduce our tax liability there are some more expenses where we can avail the benefit of this deduction like, Section – 80G where an assesee may claim the deduction in respect to Donation upto 100% or 50% of the aggregate amount or qualifying limit of donation depend on the certain conditions.

If assesee has not own residential property at the place where he/she currently employed and pays rent to someone the he may claim the deduction for rent paid by him under Section – 80GG but this deduction will allowed of the lower of :-

- Rs. 5,000/- per month

- 25% of Adjusted Total Income

- Rent Paid Less 10% of Adjusted Total Income

| Adjusted Total Income means Income excluding : – Long Term Capital Gain (LTCG)Short Term Capital Gain uncer Section 111A or Section 115DDeduction under Section 80C to 80U |

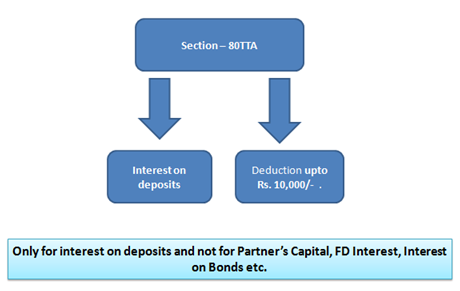

Not only on expenses or investment an assesee may also claim the deduction on his earnings. If assesee had earned any interest on deposits in saving account than he may claim deduction under Sectiom – 80TTA (available only for Individual and HUF) upto Rs. 10,000/- . As this deduction is only for interest on deposits and not for Partner’s Capital, FD Interest, Interest on Bonds etc.

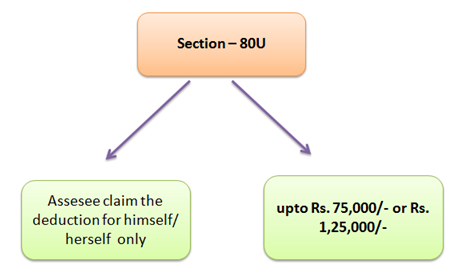

Above we discussed about Section 80DD and Section 80DDB where assesee claim the deduction of Dependent disabled but there’s a Section – 80U where assesee claim the deduction for himself/ herself upto Rs. 75,000/- or Rs. 1,25,000/- (depends on the conditions)

As these are some common deductions which an assesee may avail to reduce his tax liability but there are some more deduction in Chapter – 6A on which we discussed further so let’s connect with us with our blogs and get updated with some more interesting sections.