The ministry of corporate affairs (MCA) has in furtherance with the MCA Circular No. 10/2020, come up with the ‘Companies Fresh Start Scheme 2020’ as Government of India’s efforts to provide relief to law-abiding companies and Limited Liability Partnerships (LLPs) in the wake of COVID-19, to enable companies to make good, any filing-related defaults, irrespective of the duration of default, and make a fresh start as a fully compliant entity. As per the Scheme, companies have to pay only normal fees of the forms without any additional fees.

This scheme has brought benefits to the Defaulting companies to get all the defaults corrected without any late Fee. So it is a must take the opportunity for such companies.

1. What is the” Companies Fresh Start Scheme”?

“Companies Fresh Start Scheme, 2020” is a scheme that will give a chance to enable companies to make good, of any filing-related defaults, irrespective of the duration of default, and make a fresh start as a fully compliant entity.

The Ministry of Corporate Affairs issued a circular on March 24, 2020, giving exemption of any additional payment on late filing of an e-form by the company in Corporate Number 11/2020, to give rest to the corporate world. COVID-19 caused a global pandemic. MCA in front of Abu.

2. Who can file the e-Forms under this Scheme?

Any defaulting Company is permitted to file due documents under the scheme.

“Defaulting company” is defined under the Companies Act, 2013, and which has made a default in payment or filing of any document, statement or return (including annual filings in Form AOC-4 and MGT-7), etc will be said the defaulting company.

3. What is the period of CFSS 2020 Scheme?

The Scheme shall come in force from 01.04.2020 and will remain valid till 30.09.2020.

4. What are the Forms which can be filed under this Scheme?

Forms that can be filed under his scheme are as given below:

Some of the Important forms that can be filed are:

- AOC-4 (Form for filing the financial statement and other documents with the Registrar)

- ADT-1 (Information to the Registrar by the company for appointment of auditor)

- ADT-3 (Notice of Resignation by the Auditor)

- DIR-12 (Particulars of appointment of directors and the key managerial personnel and the changes among them)

- MGT-7 (Annual Return)

- DIR-3 KYC/Web form (Application for KYC of Directors)

5. Who is the designated authority?

Registrar of Companies having jurisdiction over the registered office of the Company.

6. What is the situation if the Adjournment Authority has prosecuted or proceeded or issued an order?

The immunity from prosecution or the commencement of proceedings under the Act (both 1956 and 2013 Act) shall be against the filed of documents only.

The immunity will not cover any other resulting proceedings that involve the interest of the stakeholder.

Immunity shall not be against the matter pending in the Court of law/ Management disputes before the court or tribunal.

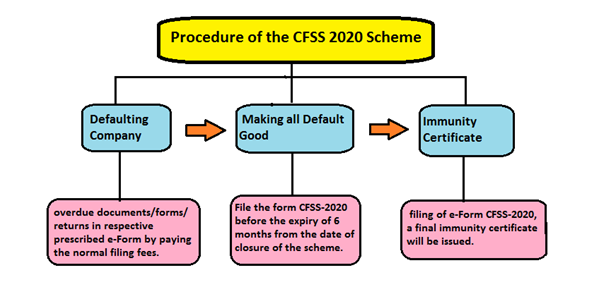

7. What is the procedure of the CFSS 2020 Scheme?

The defaulting company needs to file overdue documents/forms/ returns in respective prescribed e-Form by paying the normal filing fee within the immunity period.

The defaulting company shall file Form CFSS-2020, after rectifying all defaults by filing prescribed e-Forms and the same should have been approved. CFSS-2020 must be filed before the expiry of 6 months from the date of closure of the scheme.

Based on the filing of e-Form CFSS-2020, a final immunity certificate will be issued.

8. What are the fees for filing the E-form CFSS- 2020?

There are no fees for filing the for E form CFSS-2020 to be paid.

9. What are the forms which cannot be filed under this Scheme?

The forms related to increase of share capital and charge forms are excluded from this scheme i.e. SH-7, CHG 1, CHG 4, CHG 8 / CHG 9, etc.

10. Non-Applicability of Companies Fresh Start Scheme, 2020 (CFSS-2020)

This scheme shall not apply in the following cases: –

- To any company against which Final notice for striking off the name of the company under section 248 of the companies act, 2013 already issued by the designated authority.

- Where the company has already made an application for striking off the name of the company from the Registrar office.

- To companies that have amalgamated under the scheme of compromise.

- Where applications have already filed for obtaining Dormant status under section 455 of the companies act, 2013 before the scheme

- To Vanishing Companies

- Documents related to Increase in authorized share capital (FormSH-7)

- Charge related documents (CHG-1, CHG-4, CHG-8 &CHG-9)

If you have any query related to this article or any other article than please contact us