What is Advance Income Tax?

It simply means that tax needed to be paid in advance and it has been mandated by Section 208 of Income Tax Act. Advance tax payment has to be made as per the due dates provided in the Income Tax Act.

Who should pay Advance Income Tax?

Every person, whose tax liability, for the financial year is more than Rs. 10,000 should pay advance income tax.

Section 208 of Income Tax reads as follows, “Advance tax shall be payable during a financial year in every case where the amount of such tax payable by the assessee during that year, as computed in accordance with the provisions of this Chapter, is ten thousand rupees or more”

What are the consequences, if advance tax not paid?

If advance income tax is not paid on or before the due date, then interest U/s 234B and 234C has to be paid on the amount of advance income tax. The interest rate is 1% under both sections. This simply means there needed to be paid 24% interest annually if the advance tax is not paid on time.

What are the due dates for advance income tax:

| Due Date | Advance Tax Payable |

| On or before 15th June | 15% of Total Tax should be paid |

| On or before 15th Sept | 45% of the Total Tax should be paid |

| On or before 15th Dec | 75% of the Total Tax should be paid |

| On or before 15th Mar | 100% Tax should be paid |

How to pay Advance Income Tax?

Let’s go through the process step by step for advance tax payment

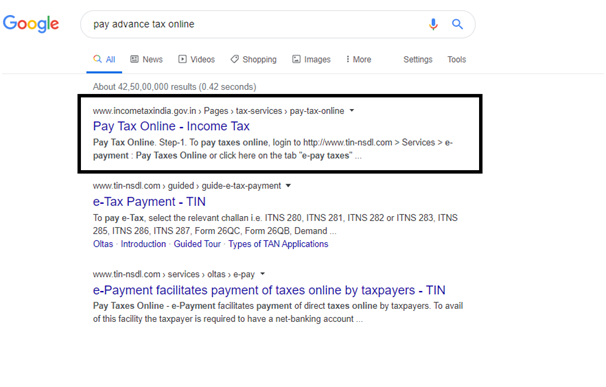

Step 1: Open the www.google.com

Step 2: Now type in the search bar “Pay Advance tax online”

Step 3: Select the very first option

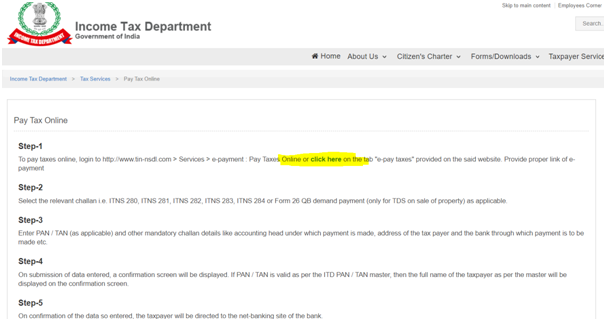

Step 4: Click on the button Click here, and select Yes

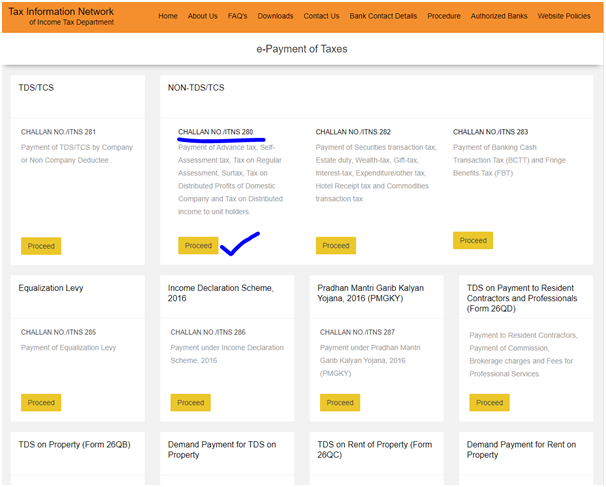

Step 5: Select the Challan No. / ITNS 280

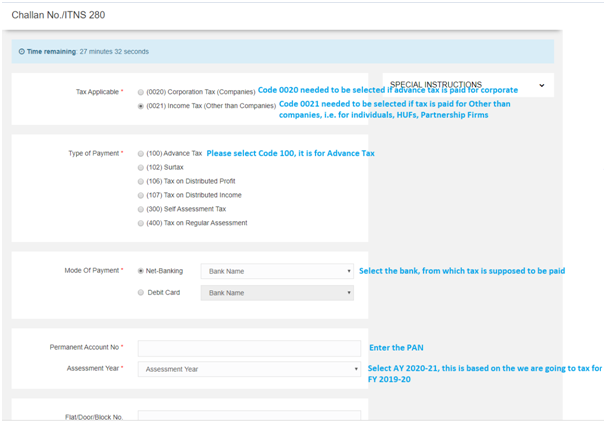

Step 6: Fill up the form and proceed for the payment of tax. After filling this form, the internet banking page will be opened, where bank details needed to be entered for payment of tax. After bank details, we also need to specify the amount of advance tax that we need to pay. Filling this form correctly is really important. Let us understand the few points which are really important for filling this form:

Advance tax payment is really important as it is always beneficial for everyone. The biggest advantage of advance tax payment is that we can contribute in nation-building as well as can save huge interest liability